User:Seraphim System/sandbox/greece

The Greek government-debt crisis (also known as the Greek Depression)[2][3][4] is the sovereign debt crisis faced by Greece in the aftermath of the financial crisis of 2007–08. Widely known in the country as The Crisis (Greek: Η Κρίση), it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis.[5][6]

The Greek crisis started in late 2009, triggered by the turmoil of the Great Recession, structural weaknesses in the Greek economy, and revelations that previous data on government debt levels and deficits had been undercounted by the Greek government.[7][8][9]

This led to a crisis of confidence, indicated by a widening of bond yield spreads and rising cost of risk insurance on credit default swaps compared to the other Eurozone countries, particularly Germany.[10][11] The government enacted 12 rounds of tax increases, spending cuts, and reforms from 2010 to 2016, which at times triggered local riots and nationwide protests. Despite these efforts, the country required bailout loans in 2010, 2012, and 2015 from the International Monetary Fund, Eurogroup, and European Central Bank, and negotiated a 50% "haircut" on debt owed to private banks in 2011. After a popular referendum which rejected further austerity measures required for the third bailout, and after closure of banks across the country (which lasted for several weeks), on June 30, 2015, Greece became the first developed country to fail to make an IMF loan repayment.[12] At that time, debt levels had reached €323bn or some €30,000 per capita.[13]

Overview

[edit]

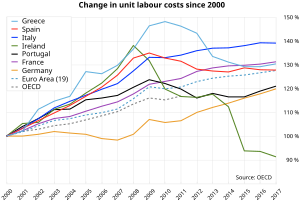

The 2001 introduction of the euro reduced trade costs among Eurozone countries, increasing overall trade volume. Labour costs increased more (from a lower base) in peripheral countries such as Greece relative to core countries such as Germany, eroding Greece's competitive edge. As a result, Greece's current account (trade) deficit rose significantly.[14]

A trade deficit means that a country is consuming more than it produces, which requires borrowing/direct investment from other countries.[14] Both the Greek trade deficit and budget deficit rose from below 5% of GDP in 1999 to peak around 15% of GDP in the 2008–2009 periods.[15] One driver of the investment inflow was Greece's membership in the EU and the Eurozone. Greece was perceived as a higher credit risk alone than it was as a member of the Eurozone, which implied that investors felt the EU would bring discipline to its finances and support Greece in the event of problems.[16]

As the Great Recession spread to Europe, the amount funds lent from the European core countries (e.g. Germany) to the peripheral countries such as Greece began to decline. Reports in 2009 of Greek fiscal mismanagement and deception increased borrowing costs; the combination meant Greece could no longer borrow to finance its trade and budget deficits at an affordable cost.[14]

A country facing a “sudden stop” in private investment and a high (local currency) debt load typically allows its currency to depreciate to encourage investment and to pay back the debt in cheaper currency. This was not possible while Greece remained on the Euro.[14] Instead, to become more competitive, Greek wages fell nearly 20% from mid-2010 to 2014, a form of deflation.[citation needed] This significantly reduced income and GDP, resulting in a severe recession, decline in tax receipts and a significant rise in the debt-to-GDP ratio. Unemployment reached nearly 25%, from below 10% in 2003. Significant government spending cuts helped the Greek government return to a primary budget surplus by 2014 (collecting more revenue than it paid out, excluding interest).[17]

Causes

[edit]In January 2010, the Greek Ministry of Finance published Stability and Growth Program 2010.[18] The report listed five main causes, poor GDP growth, government debt and deficits, budget compliance and data credibility. Causes found by others included excess government spending, current account deficits and tax avoidance.

GDP growth

[edit]After 2008, GDP growth was lower than the Greek national statistical agency had anticipated. The Greek Ministry of Finance reported the need to improve competitiveness by reducing salaries and bureaucracy[18] and to redirect governmental spending from non-growth sectors such as the military into growth-stimulating sectors.

The global financial crisis had a particularly large negative impact on GDP growth rates in Greece. Two of the country's largest earners, tourism and shipping were badly affected by the downturn, with revenues falling 15% in 2009.[19]

Government deficit

[edit]Fiscal imbalances developed from 2004 to 2009: "output increased in nominal terms by 40%, while central government primary expenditures increased by 87% against an increase of only 31% in tax revenues." The Ministry intended to implement real expenditure cuts that would allow expenditures to grow 3.8% from 2009 to 2013, well below expected inflation at 6.9%. Overall revenues were expected to grow 31.5% from 2009 to 2013, secured by new, higher taxes and by a major reform of the ineffective tax collection system. The deficit needed to decline to a level compatible with a declining debt-to-GDP ratio.

Government debt

[edit]The debt increased in 2009 due to the higher than expected government deficit and higher debt-service costs. The Greek government assessed that structural economic reforms would be insufficient, as the debt would still increase to an unsustainable level before the positive results of reforms could be achieved. In addition to structural reforms, permanent and temporary austerity measures (with a size relative to GDP of 4.0% in 2010, 3.1% in 2011, 2.8% in 2012 and 0.8% in 2013) were needed. Reforms and austerity measures, in combination with an expected return of positive economic growth in 2011, would reduce the baseline deficit from €30.6 billion in 2009 to €5.7 billion in 2013, while the debt/GDP ratio would stabilize at 120% in 2010–2011 and decline in 2012 and 2013.

After 1993, the debt-to-GDP ratio remained above 94%.[20] The crisis caused the debt level to exceed the maximum sustainable level (defined by IMF economists to be 120%). According to "The Economic Adjustment Programme for Greece" published by the EU Commission in October 2011, the debt level was expected to reach 198% in 2012, if the proposed debt restructure agreement was not implemented.[21]

Budget compliance

[edit]Budget compliance was acknowledged to need improvement. For 2009 it was found to be "a lot worse than normal, due to economic control being more lax in a year with political elections". The government wanted to strengthen the monitoring system in 2010, making it possible to track revenues and expenses, at both national and local levels.

Data credibility

[edit]Problems with unreliable data had existed since Greece applied for Euro membership in 1999.[22] In the five years from 2005 to 2009, Eurostat each year noted reservations about Greek fiscal data. Previously reported figures were consistently revised down.[23][24][25] The flawed data made it impossible to predict GDP growth, deficit and debt. By the end of each year, all were below estimates. Data problems were evident in several other countries, but in the case of Greece, the magnitude of the 2009 revisions increased suspicion about data quality.

In May 2010, the Greek government deficit was again revised and estimated to be 13.6%,[26] the second highest in the world relative to GDP behind Iceland at 15.7% and Great Britain third at 12.6%.[27] The government forecast public debt to hit 120% of GDP during 2010.[28] The actual ratio, after the debt crisis, the 2010 bailout, and the GDP contraction, ended up being close to 150%.[29]

The revised statistics revealed that Greece from 2000 to 2010 had exceeded the Eurozone stability criteria, with yearly deficits exceeding the recommended maximum limit at 3.0% of GDP, and with the debt level significantly above the limit of 60% of GDP.

Government spending

[edit]

The Greek economy was one of the Eurozone's fastest growing from 2000 to 2007, averaging 4.2% annually, as foreign capital flooded in.[30] This capital inflow coincided with a higher budget deficit.[15]

Greece had budget surpluses from 1960–73, but thereafter it had budget deficits.[31][32][33] From 1974–80 the government had budget deficits below 3% of GDP, while 1981–2013 deficits were above 3%.[32][33][34][35]

An editorial published by Kathimerini claimed that after the removal of the right-wing military junta in 1974, Greek governments wanted to bring left-leaning Greeks into the economic mainstream[36] and so ran large deficits to finance military expenditures, public sector jobs, pensions and other social benefits.

As a percentage of GDP, Greece had the second-biggest defense spending[37] in NATO, after the US.

Pre-Euro, currency devaluation helped to finance Greek government borrowing. Thereafter the tool disappeared. Greece was able to continue borrowing because of the lower interest rates for Euro bonds, in combination with strong GDP growth.

Current account balance

[edit]

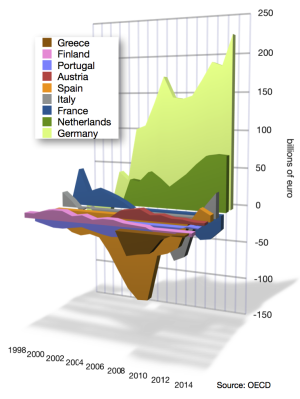

Economist Paul Krugman wrote, "What we’re basically looking at...is a balance of payments problem, in which capital flooded south after the creation of the euro, leading to overvaluation in southern Europe"[38] and "In truth, this has never been a fiscal crisis at its root; it has always been a balance of payments crisis that manifests itself in part in budget problems, which have then been pushed onto the center of the stage by ideology."[39]

The translation of trade deficits to budget deficits works through sectoral balances. Greece ran current account (trade) deficits averaging 9.1% GDP from 2000–2011.[15] By definition, a trade deficit requires capital inflow (mainly borrowing) to fund; this is referred to as a capital surplus or foreign financial surplus. This can drive higher levels of government budget deficits, if the private sector maintains relatively even amounts of savings and investment, as the three financial sectors (foreign, government, and private) by definition must balance to zero.

Greece's large budget deficit was funded by running a large foreign financial surplus. As the inflow of money stopped during the crisis, reducing the foreign financial surplus, Greece was forced to reduce its budget deficit substantially. Countries facing such a sudden reversal in capital flows typically devalue their currencies to resume the inflow of capital; however, Greece was unable to do this, and so has instead suffered significant income (GDP) reduction, another form of devaluation.[14][15]

Tax evasion

[edit]The ability to pay its debts depends greatly on the amount of tax the government is able to collect. In Greece, tax receipts were consistently below the expected level. In 2010, estimated tax evasion losses for the Greek government amounted to over $20 billion.[40] Estimates indicated that the government collected less than half of the revenues due in 2012.[41]

Greece scored 36/100 according to Transparency International's Corruption Perception Index, ranking it as the most corrupt country in the EU.[42][43] One bailout condition was to implement an anti-corruption strategy.[44] The government's activities improved their score of 43/100 in 2014, still the lowest in the EU, but close to that of Italy, Bulgaria and Romania.[42][45]

Data for 2012 indicated that the Greek "black economy" or "underground economy", from which little or no tax was collected, was a full 24.3% of GDP.[46][47] Also in 2012, Swiss estimates suggested that Greeks had some 20 billion euros in Switzerland of which only one percent had been declared as taxable in Greece.[48] In 2015, estimates indicated that the amount of evaded taxes stored in Swiss banks was around 80 billion euros.[49][50]

A mid-2017 report indicated Greeks were being "taxed to the hilt" and many believed that the risk of penalties for tax evasion were less serious than the risk of bankruptcy. One method of evasion that was continuing was the so-called "black market" or "grey economy" or "underground economy": work is done for cash payment which is not declared as income; as well, VAT is not collected and remitted.[51] A January 2017 report[52] by the DiaNEOsis think-tank indicated that unpaid taxes in Greece at the time totaled approximately 95 billion euros, up from 76 billion euros in 2015, much of it was expected to be uncollectable. Another early 2017 study estimated that the loss to the government as a result of tax evasion was between 6% and 9% of the country's GDP, or roughly between 11 billion and 16 billion euros per annum.[53]

The shortfall in the collection of VAT (sales tax) was also significant. In 2014, the government collected 28% less than was owed to it; this shortfall was about double the average for the EU. The uncollected amount that year was about 4.9 billion euros.[54] The 2017 DiaNEOsis study estimated that 3.5% of GDP was lost due to VAT fraud, while losses due to smuggling of alcohol, tobacco and petrol amounted to approximately another 0.5% of the country's GDP.[55]

Methods to reduce tax evasion

[edit]Following similar actions by the United Kingdom and Germany, the Greek government was in talks with Switzerland in 2011, attempting to force Swiss banks to reveal information on the bank accounts of Greek citizens.[56] The Ministry of Finance stated that Greeks with Swiss bank accounts would either be required to pay a tax or reveal information such as the identity of the bank account holder to the Greek internal revenue services.[56] The Greek and Swiss governments hoped to reach a deal on the matter by the end of 2011.[56]

The solution demanded by Greece still had not been effected as of 2015. That year, estimates indicated that the amount of evaded taxes stored in Swiss banks was around 80 billion euros. By then, however, a tax treaty to address this issue was under serious negotiation between the Greek and Swiss governments.[57][58] An agreement was finally ratified by Switzerland on 1 March 2016 creating a new tax transparency law that would allow for a more effective battle against tax evasion. Starting in 2018, banks in both Greece and Switzerland will exchange information about the bank accounts of citizens of the other country to minimize the possibility of hiding untaxed income.[59]

In 2016 and 2017, the government was encouraging the use of credit card or debit cards to pay for goods and services in order to reduce cash only payments. By January 2017, taxpayers were only granted tax-allowances or deductions when payments were made electronically, with a "paper trail" of the transactions that the government could easily audit. This was expected to reduce the problem of businesses taking payments but not issuing an invoice;[60] that tactic had been used by various companies to avoid payment of VAT (sales) tax as well as income tax.[61][62]

By 28 July 2017, numerous businesses were required by law to install a Point of sale (POS) device to enable them to accept payment by credit or debit card. Failure to comply with the electronic payment facility can lead to fines of up to 1,500 euros. The requirement applied to around 400,000 firms or individuals in 85 professions. The greater use of cards was one of the factors that had already achieved significant increases in VAT collection in 2016.[63]

Chronology

[edit]2010 revelations and IMF bailout

[edit]Despite the crisis, the Greek government's bond auction in January 2010 of €8 bn 5-year bonds was 4x over-subscribed.[64] The next auction (March) sold €5bn in 10-year bonds reached 3x.[65] However, yields increased, which worsened the deficit. In April 2010, it was estimated that up to 70% of Greek government bonds were held by foreign investors, primarily banks.[66]

In April, after publication of GDP data which showed an intermittent period of recession starting in 2007,[67] credit rating agencies then downgraded Greek bonds to junk status in late April 2010. This froze private capital markets, and put Greece in danger of sovereign default without a bailout.[68]

On 2 May, the European Commission, European Central Bank (ECB) and International Monetary Fund (IMF) (the Troika) launched a €110 billion bailout loan to rescue Greece from sovereign default and cover its financial needs through June 2013, conditional on implementation of austerity measures, structural reforms and privatization of government assets.[69] The bailout loans were mainly used to pay for the maturing bonds, but also to finance the continued yearly budget deficits.[citation needed]

Fraudulent statistics

[edit]To keep within the monetary union guidelines, the government of Greece for many years simply misreported economic statistics.[70][71] At the beginning of 2010, it was discovered Goldman Sachs and other banks helped the Greek government to hide its debts.[72] Christoforos Sardelis, former head of Greece’s Public Debt Management Agency, said that the country did not understand what it was buying. He also said he learned that "other EU countries such as Italy" had made similar deals.[73][74][75][76][77]

Most notable was a cross currency swap, where billions worth of Greek debts and loans were converted into yen and dollars at a fictitious exchange rate, thus hiding the true extent of Greek loans.[78] Swaps were not registered as debt because Eurostat statistics did not include financial derivatives. A German derivatives dealer commented, "The Maastricht rules can be circumvented quite legally through swaps," and "In previous years, Italy used a similar trick to mask its true debt with the help of a different US bank."[75] These conditions enabled Greece and other governments to spend beyond their means, while ostensibly meeting EU deficit targets.[76][79]

The European statistics agency, Eurostat, had at regular intervals from 2004-2010, sent 10 delegations to Athens with a view to improving the reliability of Greek statistical figures. In January it issued a report that contained accusations of falsified data and political interference.[80] The Finance Ministry accepted the need to restore trust among investors and correct methodological flaws, "by making the National Statistics Service an independent legal entity and phasing in, during the first quarter of 2010, all the necessary checks and balances".[18]

The new government of George Papandreou revised the 2009 deficit from a previously estimated 6%–8% to 15.7% of GDP, using Eurostat's standardized method. The figure for Greek government debt at the end of 2009 increased from its first November estimate at €269.3 billion (113% of GDP)[66][81] to a revised €299.7 billion (130% of GDP). This was the highest for any EU country. After an in-depth Financial Audit of the fiscal years 2006–09. Eurostat announced in November 2010 that the revised figures for 2006–2009 finally were considered to be reliable.[82][83][84]

2011

[edit]A year later, a worsened recession along with the poor performance of the Greek government in achieving the conditions of the agreed bailout, forced a second bailout. In July 2011, private creditors agreed to a voluntary haircut of 21 percent on their Greek debt, but Euro zone officials considered this write-down to be insufficient.[85] Especially Mr. Schaeuble, the German finance minister, and Mrs. Merkel, the German chancellor, "pushed private creditors to accept a 50 percent loss on their Greek bonds"[86], while Mr. Trichet of the European Central Bank had long opposed a haircut for private investors, "fearing that it could undermine the vulnerable European banking system"[87]. When private investors agreed to accept bigger losses, the Troika launched the second bailout worth €130 billion. This included a bank recapitalization package worth €48bn. Private bondholders were required to accept extended maturities, lower interest rates and a 53.5% reduction in the bonds' face value.[88]

On 17 October 2011, Minister of Finance Evangelos Venizelos announced that the government would establish a new fund, aimed at helping those who were hit the hardest from the government's austerity measures.[89] The money for this agency would come from a crackdown on tax evasion.[89] The government agreed to creditor proposals that Greece raise up to €50 billion through the sale or development of state-owned assets,[90] but receipts were much lower than expected, while the policy was strongly opposed by Syriza. In 2014, only €530m was raised. Some key assets were sold to insiders.[91]

2012

[edit]The second bailout programme was ratified in February 2012. A total of €240 billion was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014

[edit]The fourth review of the bailout programme revealed unexpected financing gaps.[92][93] In 2014 the outlook for the Greek economy improved. The government predicted a structural surplus in 2014,[94][95] opening access to the private lending market to the extent that its entire financing gap for 2014 was covered via private bond sales.[96]

Instead a fourth recession started in Q4-2014.[97] The parliament called snap parliamentary elections in December, leading to a Syriza-led government that rejected the existing bailout terms.[98] The Troika suspended all scheduled remaining aid to Greece, until the Greek government retreated or convinced the Troika to accept a revised programme.[99] This rift caused a liquidity crisis (both for the Greek government and Greek financial system), plummeting stock prices at the Athens Stock Exchange and a renewed loss of access to private financing.

2015

[edit]After Greece's January snap election, the Troika granted a further four-month technical extension of its bailout programme; expecting that the payment terms would be renegotiated before the end of April,[100] allowing the review and last financial transfer could be completed before the end of June.[101]

Facing sovereign default, the government made new proposals in the first[104] and second half of June.[105] Both were rejected, raising the prospect of recessionary capital controls to avoid a collapse of the banking sector – and exit from the Eurozone.[106][107]

The government unilaterally broke off negotiations on 26 June.[108][109][110][111] Tsipras announced that a referendum would be held on 5 July to approve or reject the Troika's 25 June proposal.[112] The Greek stock market closed on 27 June.[113]

The government campaigned for rejection of the proposal, while four opposition parties (PASOK, To Potami, KIDISO and New Democracy) objected that the proposed referendum was unconstitutional. They petitioned for the parliament or president to reject the referendum proposal.[114] Meanwhile, the Eurogroup announced that the existing second bailout agreement would technically expire on 30 June, 5 days before the referendum.[109][111]

The Eurogroup clarified on 27 June that only if an agreement was reached prior to 30 June could the bailout be extended until the referendum on 5 July. The Eurogroup wanted the government to take some responsibility for the subsequent program, presuming that the referendum resulted in approval.[115] The Eurogroup had signaled willingness to uphold their "November 2012 debt relief promise", presuming a final agreement.[105] This promise was that if Greece completed the program, but its debt-to-GDP ratio subsequently was forecast to be over 124% in 2020 or 110% in 2022 for any reason, then the Eurozone would provide debt-relief sufficient to ensure that these two targets would still be met.[116]

On 28 June the referendum was approved by the Greek parliament with no interim bailout agreement. The ECB decided to maintain its Emergency Liquidity Assistance to Greek banks. Many Greeks continued to withdraw cash from their accounts fearing that capital controls would soon be invoked.

On 5 July a large majority voted to reject the bailout terms (a 61% to 39% decision with 62.5% voter turnout). This caused stock indexes worldwide to tumble, fearing Greece's potential exit from the Eurozone ("Grexit"). Following the vote, Greece's finance minister Yanis Varoufakis stepped down on 6 July and was replaced by Euclid Tsakalotos.[117]

On 13 July, after 17 hours of negotiations, Eurozone leaders reached a provisional agreement on a third bailout programme, substantially the same as their June proposal. Many financial analysts, including the largest private holder of Greek debt, private equity firm manager, Paul Kazarian, found issue with its findings, citing it as a distortion of net debt position.[118][119]

2017

[edit]On February 20, 2017, the Greek finance ministry reported that the government’s debt load is now €226.36 billion after increasing by €2.65 billion in the previous quarter.[120] By the middle of 2017, the yield on Greek government bonds began approaching pre-2010 levels, signalling a potential return to economic normalcy for the country.[121] According to the International Monetary Fund (IMF), Greece’s GDP will grow by 2.8% in 2017. According to Trading Economics forecasts, the country’s economy will continue to grow by 1.2% per annum on average up to 2020. [122]

The Medium-term Fiscal Strategy Framework 2018–2021 voted on 19 May 2017 introduced amendments of the provisions of the 2016 thirteenth austerity package.[123][124]

In June 2017, news reports indicated that the "crushing debt burden" had not been alleviated and that Greece was at the risk of defaulting on some payments.[125] The International Monetary Fund stated that the country should be able to borrow again "in due course”. At the time, the Euro zone gave Greece another credit of $9.5-billion, $8.5 billion of loans and brief details of a possible debt relief with the assistance of the IMF.[126] On 13 July, the Greek government sent a letter of intent to the IMF with 21 commitments it promised to meet by June 2018. They included changes in labour laws, a plan to cap public sector work contracts, to transform temporary contracts into permanent agreements and to recalculate pension payments to reduce spending on social security.[127]

Bailout programmes

[edit]First Economic Adjustment Programme (May 2010 – June 2011)

[edit]This article appears to contradict the article First Economic Adjustment Programme for Greece. (December 2014) |

On 1 May 2010, the Greek government announced a series of austerity measures[128][129] The next day the Eurozone countries and the IMF agreed to a three-year €110 billion loan, paying 5.5% interest,[130] conditional on the implementation of austerity measures. Credit rating agencies immediately downgraded Greek governmental bonds to an even lower junk status.

The programme was met with anger by the Greek public, leading to protests, riots and social unrest. On 5 May 2010, a national strike was held in opposition.[129] Nevertheless, the austerity package was approved on 29 June 2011, with 155 out of 300 members of parliament voting in favour.

Second Economic Adjustment Programme (July 2011 – )

[edit]At a 21 July 2011 summit in Brussels, Euro area leaders agreed to extend Greek (as well as Irish and Portuguese) loan repayment periods from 7 years to a minimum of 15 years and to cut interest rates to 3.5%. They also approved an additional €109 billion support package, with exact content to be finalized at a later summit.[131] On 27 October 2011, Eurozone leaders and the IMF settled an agreement with banks whereby they accepted a 50% write-off of (part of) Greek debt.[132][133][134]

Greece brought down its primary deficit from €25bn (11% of GDP) in 2009 to €5bn (2.4% of GDP) in 2011.[135] However, the Greek recession worsened. Overall 2011 Greek GDP experienced a 7.1% decline.[136] The unemployment rate grew from 7.5% in September 2008 to an unprecedented 19.9% in November 2011.[137][138]

Third Economic Adjustment Programme

[edit]This section is empty. You can help by adding to it. (January 2018) |

Differences in effects on the GDP compared to the programmes for other Eurozone bailed-out countries

[edit]There were key differences in the effects of the Greek programme compared to these for other Eurozone bailed-out countries. According to the applied programme, Greece had to accomplish by far the largest fiscal adjustment (by more than 9 points of GDP between 2010 and 2012[139]), "a record fiscal consolidation by OECD standards "[140]. Between 2009 and 2014 the change (improvement) in structural primary balance was 16.1 points of GDP for Greece, compared to 8.5 for Portugal, 7.3 for Spain, 7.2 for Ireland, and 5.6 for Cyprus[141].

The negative effects of such a rapid fiscal adjustment on the Greek GDP, and thus the scale of resulting increase of the Debt to GDP ratio, had been underestimated by the IMF, apparently due to a calculation error[142]. Indeed, the result was a magnification of the debt problem. Even if the amount of debt would remain the same, Greece's Debt to GDP ratio of 127% in 2009[143] would still jump to about 170% - considered unsustainable - solely due to the drop in GDP (which fell by more than 25% between 2009 and 2014). The much larger scale of the above effects does not allow a meaningful comparison with the performance of programmes in other bailed-out countries.

Bank recapitalization

[edit]The Hellenic Financial Stability Fund (HFSF) completed a €48.2bn bank recapitalization in June 2013, of which the first €24.4bn were injected into the four biggest Greek banks. Initially, this recapitalization was accounted for as a debt increase that elevated the debt-to-GDP ratio by 24.8 points by the end of 2012. In return for this, the government received shares in those banks, which it could later sell (per March 2012 was expected to generate €16bn of extra "privatization income" for the Greek government, to be realized during 2013–2020).ecb

HFSF offered three out of the four big Greek banks (NBG, Alpha and Piraeus) warrants to buy back all HFSF bank shares in semi-annual exercise periods up to December 2017, at some predefined strike prices.,[144] These banks acquired additional private investor capital contribution at minimum 10% of the conducted recapitalization. Eurobank, failed to attract private investor participation and thus became almost entirely financed/owned by HFSF. During the first warrant period, the shareholders in Alpha bank bought back the first 2.4% of HFSF shares.[145] Shareholders in Piraeus Bank bought back the first 0.07% of HFSF shares.[146] National Bank (NBG) shareholders bought back the first 0.01% of the HFSF shares, because the market share price was cheaper than the strike price.[147] Shares not sold by the end of December 2017 may be sold to alternative investors.[144]

In May 2014, a second round of bank recapitalization worth €8.3bn was concluded, financed by private investors. All six commercial banks (Alpha, Eurobank, NBG, Piraeus, Attica and Panellinia) participated.[44] HFSF did not tap into their current €11.5bn reserve capital fund.[148] Eurobank in the second round was bale to attract private investors.[149] This required HFSF to dilute their ownership from 95.2% to 34.7%.[150]

According to HFSF's third quarter 2014 financial report, the fund expected to recover €27.3bn out of the initial €48.2bn. This amount included "A €0.6bn positive cash balance stemming from its previous selling of warrants (selling of recapitalization shares) and liquidation of assets, €2.8bn estimated to be recovered from liquidation of assets held by its 'bad asset bank', €10.9bn of EFSF bonds still held as capital reserve, and €13bn from its future sale of recapitalization shares in the four systemic banks." The last figure is affected by the highest amount of uncertainty, as it directly reflects the current market price of the remaining shares held in the four systemic banks (66.4% in Alpha, 35.4% in Eurobank, 57.2% in NBG, 66.9% in Piraeus), which for HFSF had a combined market value of €22.6bn by the end of 2013 – declining to €13bn on 10 December 2014.[151]

Once HFSF liquidates its assets, the total amount of recovered capital will be returned to the Greek government to help to reduce its debt. In early December 2014, the Bank of Greece allowed HFSF to repay the first €9.3bn out of its €11.3bn reserve to the Greek government.[152] A few months later, the remaining HFSF reserves were likewise approved for repayment to ECB, resulting in redeeming €11.4bn in notes during the first quarter of 2015.[153]

Creditors

[edit]Initially, European banks had the largest holdings of Greek debt. However, this shifted as the "troika" (ECB, IMF and a European government-sponsored fund) purchased Greek bonds. As of early 2015, the largest individual contributors to the fund were Germany, France and Italy with roughly €130bn total of the €323bn debt.[154] The IMF was owed €32bn and the ECB €20bn. Foreign banks had little Greek debt.[155]

European banks

[edit]Excluding Greek banks, European banks had €45.8bn exposure to Greece in June 2011.[156] However, by early 2015 their holdings had declined to roughly €2.4bn.[155]

European Investment Bank

[edit]In November 2015, the European Investment Bank (EIB) lent Greece about 285 million euros. This extended the 2014 deal that EIB would lend 670 million euros.[157] It was thought that the Greek government would invest the money on Greece's energy industries so as to ensure energy security and manage environmentally friendly projects.[158] Werner Hoyer, the president of EIB, expected the investment to boost employment and have a positive impact on Greece's economy and environment.

Greek public opinion

[edit]

According to a poll in February 2012 by Public Issue and SKAI Channel, PASOK—which won the national elections of 2009 with 43.92% of the vote—had seen its approval rating decline to 8%, placing it fifth after centre-right New Democracy (31%), left-wing Democratic Left (18%), far-left Communist Party of Greece (KKE) (12.5%) and radical left Syriza (12%). The same poll suggested that Papandreou was the least popular political leader with a 9% approval rating, while 71% of Greeks did not trust him.[159]

In a May 2011 poll, 62% of respondents felt that the IMF memorandum that Greece signed in 2010 was a bad decision that hurt the country, while 80% had no faith in the Minister of Finance, Giorgos Papakonstantinou, to handle the crisis.[160] (Venizelos replaced Papakonstantinou on 17 June). 75% of those polled had a negative image of the IMF, while 65% felt it was hurting Greece's economy.[160] 64% felt that sovereign default was likely. When asked about their fears for the near future, Greeks highlighted unemployment (97%), poverty (93%) and the closure of businesses (92%).[160]

Polls showed that the vast majority of Greeks are not in favour of leaving the Eurozone.[161] Nonetheless, other 2012 polls showed that almost half (48%) of Greeks were in favour of default, in contrast with a minority (38%) who are not.[162]

Economic and social effects

[edit]

Economic effects

[edit]Greek GDP's worst decline, −6.9%, came in 2011,[163] a year in which seasonally adjusted industrial output ended 28.4% lower than in 2005.[164][165] During that year, 111,000 Greek companies went bankrupt (27% higher than in 2010).[166][167] As a result, the seasonally adjusted unemployment rate grew from 7.5% in September 2008 to a then record high of 23.1% in May 2012, while the youth unemployment rate time rose from 22.0% to 54.9%.[137][138][168]

Key statistics are summarized below, with a detailed table at the bottom of the article. According to the CIA World Factbook and Eurostat:

- Greek GDP fell from €242 billion in 2008 to €179 billion in 2014, a 26% decline. Greece was in recession for over five years, emerging in 2014 by some measures. This fall in GDP dramatically increased the Debt to GDP ratio, severely worsening Greece's debt crisis.

- GDP per capita fell from a peak of €22,500 in 2007 to €17,000 in 2014, a 24% decline.

- The public debt to GDP ratio in 2014 was 177% of GDP or €317 billion. This ratio was the world's third highest after Japan and Zimbabwe. Public debt peaked at €356 billion in 2011; it was reduced by a bailout program to €305 billion in 2012 and then rose slightly.

- The annual budget deficit (expenses over revenues) was 3.4% GDP in 2014, much improved versus the 15% of 2009.

- Tax revenues for 2014 were €86 billion (about 48% GDP), while expenditures were €89.5 billion (about 50% GDP).

- The unemployment rate rose from below 10% (2005–2009) to around 25% (2014–2015).

- An estimated 44% of Greeks lived below the poverty line in 2014.[169][170]

Greece defaulted on a $1.7 billion IMF payment on June 29, 2015. The government had requested a two-year bailout from lenders for roughly $30 billion, its third in six years, but did not receive it.[171]

The IMF reported on 2 July 2015 that the "debt dynamics" of Greece were "unsustainable" due to its already high debt level and "...significant changes in policies since [2014]—not least, lower primary surpluses and a weak reform effort that will weigh on growth and privatization—[which] are leading to substantial new financing needs." The report stated that debt reduction (haircuts, in which creditors sustain losses through debt principal reduction) would be required if the package of reforms under consideration were weakened further.[172]

Taxation

[edit]As of 2016, five indirect taxes had been added to goods and services. At 23%, the value added tax is one of the Eurozone's highest, exceeding other EU countries on small and medium-sized enterprises.[173] One researcher found that the poorest households faced tax increases of 337%.[174]

The ensuing tax policies are accused for having the opposite effects than intended, namely reducing instead of increasing the revenues, as high taxation discourages transactions and encourages tax evasion, thus perpetuating the depression.[175] Some firms relocated abroad to avoid the country's higher tax rates.[173]

The fear of higher taxes increasing tax evasion seems to ring true. Greece not only has some of the highest taxes in Europe, it also has major problems in terms of tax collection. The VAT deficit due to tax evasion is estimated at 34% in early 2017.[176] Tax debts in Greece are now equal to 90% of annual tax revenue, which is the worst number in all industrialized nations. Much of this is due to the fact that Greece has a vast underground economy, which was estimated to be about the size of a quarter of the country’s GDP before the crisis. The International Monetary Fund therefore argued in 2015 that Greece’s debt crisis could be almost completely resolved if the country’s government found a way to solve the tax evasion problem.[177]

Tax evasion

[edit]By 2010, tax receipts consistently were below the expected level. In 2010, estimated tax evasion losses for the Greek government amounted to over $20 billion.[178] 2013 figures showed that the government collected less than half of the revenues due in 2012, with the remaining tax to be paid according to a delayed payment schedule.[179][failed verification]

Greece scored 36/100 according to Transparency International's Corruption Perception Index, ranking it as the most corrupt country in the EU.[42][180] One bailout condition was to implement an anti-corruption strategy.[44] The government's activities improved their score of 43/100 in 2014, still the lowest in the EU, but close to that of Italy, Bulgaria and Romania.[42][181]

Data for 2012 placed the Greek underground or "black" economy at 24.3% of GDP,[46]

A mid-2017 report indicated Greeks have been "taxed to the hilt" and many believed that the risk of penalties for tax evasion were less serious than the risk of bankruptcy. One method of evasion is the so-called black market, grey economy or shadow economy: work is done for cash payment which is not declared as income; as well, VAT is not collected and remitted.[182] A January 2017 report[183] by the DiaNEOsis think-tank indicated that unpaid taxes in Greece at the time totaled approximately 95 billion euros, up from 76 billion euros in 2015, much of it was expected to be uncollectable. Another early 2017 study estimated that the loss to the government as a result of tax evasion was between 6% and 9% of the country's GDP, or roughly between 11 billion and 16 billion euros per annum.[184]

The shortfall in the collection of VAT (sales tax) is also significant. In 2014, the government collected 28% less than was owed to it; this shortfall is about double the average for the EU. The uncollected amount that year was about 4.9 billion euros.[185] The DiaNEOsis study estimated that 3.5% of GDP is lost due to VAT fraud, while losses due to smuggling of alcohol, tobacco and petrol amounted to approximately another 0.5% of the country's GDP.[186]

Social effects

[edit]

The social effects of the austerity measures on the Greek population were severe.[187] In February 2012, it was reported that 20,000 Greeks had been made homeless during the preceding year, and that 20 per cent of shops in the historic city centre of Athens were empty.[188]

By 2015, the Organisation for Economic Co-operation and Development (OECD) reported that nearly twenty percent of Greeks lacked funds to meet daily food expenses. Consequently, because of financial shock, unemployment directly affects debt management, isolation, and unhealthy coping mechanisms such as depression, suicide, and addiction.[189] As the economy contracted and the welfare state declined, traditionally strong Greek families came under increasing strain, attempting to cope with increasing unemployment and homeless relatives. Many unemployed Greeks cycled between friends and family members until they ran out of options and ended up in homeless shelters. These homeless had extensive work histories and were largely free of mental health and substance abuse concerns.[190]

The Greek government was unable to commit the necessary resources to homelessness, due in part to austerity measures. A program was launched to provide a stipend to assist homeless to return to their homes, but many enrollees never received grants. Various attempts were made by local governments and non-governmental agencies to alleviate the problem. The non-profit street newspaper Schedia (Greek: Σχεδία, "Raft"),[191] is sold by street vendors in Athens attracted many homeless to sell the paper. Athens opened its own shelters, the first of which was called the Hotel Ionis.[190] In 2015, the Venetis bakery chain in Athens gave away ten thousand loaves of bread a day, one-third of its production. In some of the poorest neighborhoods, according to the chain's general manager, “In the third round of austerity measures, which is beginning now, it is certain that in Greece there will be no consumers — there will be only beggars."[192]

In a study by Eurostat, it was found that 1 in 3 Greek citizens live under poverty conditions in 2016.[193]

Other effects

[edit]Horse racing has ceased operation due to the liquidation of the conducting organization.[194]

Paid soccer players will receive their salary with new tax rates.[195]

Responses

[edit]Electronic payments to reduce tax evasion

[edit]In 2016 and 2017, the government was encouraging the use of credit card or debit cards to pay for goods and services in order to reduce cash only payments. By January 2017, taxpayers were only granted tax-allowances or deductions when payments were made electronically, with a "paper trail" of the transactions. This was expected to reduce the opportunity by vendors to avoid the payment of VAT (sales) tax and income tax.[196][197]

By 28 July 2017, numerous businesses were required by law to install a point of sale device to enable them to accept payment by credit or debit card. Failure to comply with the electronic payment facility can lead to fines of up to 1,500 euros. The requirement applied to around 400,000 firms or individuals in 85 professions. The greater use of cards was one of the factors that had already achieved significant increases in VAT collection in 2016.[198]

Grexit

[edit]Krugman suggested that the Greek economy could recover from the recession by exiting the Eurozone ("Grexit") and returning to its national currency, the drachma. That would restore Greece's control over its monetary policy, allowing it to navigate the trade-offs between inflation and growth on a national basis, rather than the entire Eurozone.[199] Iceland made a dramatic recovery after it filed for bankruptcy in 2008, in part by devaluing the krona (ISK).[200][201] In 2013, it enjoyed an economic growth rate of some 3.3 percent.[202] Canada was able to improve its budget position in the 1990s by devaluing its currency.[203]

However, the consequences of "Grexit" could be global and severe, including:[16][204][205][206]

- Membership in the Eurozone would no longer be perceived as irrevocable. Other countries might be tempted to exit or demand additional debt relief. These countries might see interest rates rise on their bonds, complicating debt service.

- Geopolitical shifts, such as closer relations between Greece and Russia, as the crisis soured relations with Europe.

- Significant financial losses for Eurozone countries and the IMF, which are owed the majority of Greece's roughly €300 billion national debt.

- Adverse impact on the IMF and the credibility of its austerity strategy.

- Loss of Greek access to global capital markets and the collapse of its banking system.

Digital currency cards

[edit]Greece and other states practice fraction-reserve banking in which the amount of bank deposits far exceeds the amount of currency in circulation. Digital currency cards provide a way to make payments without the need to print/circulate more currency.[207]

Bailout

[edit]Greece could accept additional bailout funds and debt relief (i.e., bondholder haircuts or principal reductions) in exchange for greater austerity. However, austerity has damaged the economy, deflating wages, destroying jobs and reducing tax receipts, thus making it even harder to pay its debts.[citation needed] If further austerity were accompanied by enough reduction in the debt balance owed, the cost might be justifiable.[16]

European debt conference

[edit]Economist Thomas Piketty said in July 2015: "We need a conference on all of Europe’s debts, just like after World War II. A restructuring of all debt, not just in Greece but in several European countries, is inevitable." This reflected the difficulties that Spain, Portugal, Italy and Ireland had faced (along with Greece) before ECB-head Mario Draghi signaled a pivot to looser monetary policy.[208] Piketty noted that Germany received significant debt relief after World War II. He warned that: "If we start kicking states out, then....Financial markets will immediately turn on the next country."[209]

Germany's role in Greece

[edit]This section may lend undue weight to certain ideas, incidents, or controversies. Please help to create a more balanced presentation. Discuss and resolve this issue before removing this message. (July 2012) |

Germany has played a major role in discussion concerning Greece's debt crisis,[210]. Critics have accused the German government of hypocrisy; of pursuing its own national interests via an unwillingness to adjust fiscal policy in a way that would help resolve the eurozone crisis (and citing benefits it enjoyed through the crisis including falling borrowing rates, investment influx, and exports boost thanks to Euro’s depreciation[211][212][213][214][215][216][217][218]); of using the ECB to serve their country's national interests; and have criticised the nature of the austerity and debt-relief programme Greece has followed as part of the conditions attached to its bailouts.[210][219][220]

Charges of hypocrisy

[edit]Hypocrisy has been alleged on multiple bases. "Germany is coming across like a know-it-all in the debate over aid for Greece", commented Der Spiegel,[221] while its own government did not achieve a budget surplus during the era of 1970 to 2011,[222] although a budget surplus indeed was achieved by Germany in all three subsequent years (2012–2014)[223] – with a spokesman for the governing CDU party commenting that "Germany is leading by example in the eurozone – only spending money in its coffers".[224] A Bloomberg editorial, which also concluded that "Europe's taxpayers have provided as much financial support to Germany as they have to Greece", described the German role and posture in the Greek crisis thus:

In the millions of words written about Europe's debt crisis, Germany is typically cast as the responsible adult and Greece as the profligate child. Prudent Germany, the narrative goes, is loath to bail out freeloading Greece, which borrowed more than it could afford and now must suffer the consequences. [...] By December 2009, according to the Bank for International Settlements, German banks had amassed claims of $704 billion on Greece, Ireland, Italy, Portugal and Spain, much more than the German banks' aggregate capital. In other words, they lent more than they could afford. [… I]rresponsible borrowers can't exist without irresponsible lenders. Germany's banks were Greece's enablers.[225]

German economic historian Albrecht Ritschl describes his country as "king when it comes to debt. Calculated based on the amount of losses compared to economic performance, Germany was the biggest debt transgressor of the 20th century."[221] Despite calling for the Greeks to adhere to fiscal responsibility, and although Germany's tax revenues are at a record high, with the interest it has to pay on new debt at close to zero, Germany still missed its own cost-cutting targets in 2011 and is also falling behind on its goals for 2012.[226]

Allegations of hypocrisy could be made towards both sides: Germany complains of Greek corruption, yet the arms sales meant that the trade with Greece became synonymous with high-level bribery and corruption; former defence minister Akis Tsochadzopoulos was jailed in April 2012 ahead of his trial on charges of accepting an €8m bribe from Germany company Ferrostaal.[227]

Pursuit of national self-interest

[edit]"The counterpart to Germany living within its means is that others are living beyond their means", according to Philip Whyte, senior research fellow at the Centre for European Reform. "So if Germany is worried about the fact that other countries are sinking further into debt, it should be worried about the size of its trade surpluses, but it isn't."[228]

OECD projections of relative export prices—a measure of competitiveness—showed Germany beating all euro zone members except for crisis-hit Spain and Ireland for 2012, with the lead only widening in subsequent years.[229] A study by the Carnegie Endowment for International Peace in 2010 noted that "Germany, now poised to derive the greatest gains from the euro's crisis-triggered decline, should boost its domestic demand" to help the periphery recover.[230] In March 2012, Bernhard Speyer of Deutsche Bank reiterated: "If the eurozone is to adjust, southern countries must be able to run trade surpluses, and that means somebody else must run deficits. One way to do that is to allow higher inflation in Germany but I don't see any willingness in the German government to tolerate that, or to accept a current account deficit."[231] According to a research paper by Credit Suisse, "Solving the periphery economic imbalances does not only rest on the periphery countries' shoulders even if these countries have been asked to bear most of the burden. Part of the effort to re-balance Europe also has to been borne [sic] by Germany via its current account."[232] At the end of May 2012, the European Commission warned that an "orderly unwinding of intra-euro area macroeconomic imbalances is crucial for sustainable growth and stability in the euro area," and suggested Germany should "contribute to rebalancing by removing unnecessary regulatory and other constraints on domestic demand".[233] In July 2012, the IMF added its call for higher wages and prices in Germany, and for reform of parts of the country's economy to encourage more spending by its consumers.[234]

Paul Krugman estimates that Spain and other peripherals need to reduce their price levels relative to Germany by around 20 percent to become competitive again:

If Germany had 4 percent inflation, they could do that over 5 years with stable prices in the periphery—which would imply an overall eurozone inflation rate of something like 3 percent. But if Germany is going to have only 1 percent inflation, we're talking about massive deflation in the periphery, which is both hard (probably impossible) as a macroeconomic proposition, and would greatly magnify the debt burden. This is a recipe for failure, and collapse.[235]

The US has also repeatedly asked Germany to loosen fiscal policy at G7 meetings, but the Germans have repeatedly refused.[236][237]

Even with such policies, Greece and other countries would face years of hard times, but at least there would be some hope of recovery.[238] EU employment chief Laszlo Andor called for a radical change in EU crisis strategy and criticised what he described as the German practice of "wage dumping" within the eurozone to gain larger export surpluses.[239]

With regard to structural reforms required from countries at the periphery, Simon Evenett stated in 2013: "Many promoters of structural reform are honest enough to acknowledge that it generates short-term pain. (...) If you've been in a job where it is hard to be fired, labour market reform introduces insecurity, and you might be tempted to save more now there's a greater prospect of unemployment. Economy-wide labour reform might induce consumer spending cuts, adding another drag on a weakened economy."[240] Paul Krugman opposed structural reforms in accordance with his view of the task of improving the macroeconomic situation being "the responsibility of Germany and the ECB"."[241]

Claims that Germany had, by mid-2012, given Greece the equivalent of 29 times the aid given to West Germany under the Marshall Plan after World War II have been contested, with opponents claiming that aid was just a small part of Marshall Plan assistance to Germany and conflating the writing off of a majority of Germany's debt with the Marshall Plan.[242]

The version of adjustment offered by Germany and its allies is that austerity will lead to an internal devaluation, i.e. deflation, which would enable Greece gradually to regain competitiveness. This view too has been contested. A February 2013 research note by the Economics Research team at Goldman Sachs claims that the years of recession being endured by Greece "exacerbate the fiscal difficulties as the denominator of the debt-to-GDP ratio diminishes".[243]

Strictly in terms of reducing wages relative to Germany, Greece had been making progress: private-sector wages fell 5.4% in the third quarter of 2011 from a year earlier and 12% since their peak in the first quarter of 2010.[244] The second economic adjustment programme for Greece called for a further labour cost reduction in the private sector of 15% during 2012–2014.[245]

In contrast Germany's unemployment continued its downward trend to record lows in March 2012,[246] and yields on its government bonds fell to repeat record lows in the first half of 2012 (though real interest rates are actually negative).[247][248]

All of this has resulted in increased anti-German sentiment within peripheral countries like Greece and Spain.[249][250][251]

When Horst Reichenbach arrived in Athens towards the end of 2011 to head a new European Union task force, the Greek media instantly dubbed him "Third Reichenbach".[228] Almost four million German tourists—more than any other EU country—visit Greece annually, but they comprised most of the 50,000 cancelled bookings in the ten days after the 6 May 2012 Greek elections, a figure The Observer called "extraordinary". The Association of Greek Tourism Enterprises estimates that German visits for 2012 will decrease by about 25%.[252] Such is the ill-feeling, historic claims on Germany from WWII have been reopened,[253] including "a huge, never-repaid loan the nation was forced to make under Nazi occupation from 1941 to 1945."[254]

Economic statistics

[edit]| Greek national account | 1970 | 1980 | 1990 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001a | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015b | 2016b | 2017c |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Public revenued (% of GDP)[255] | — | — | 31.0d | 37.0d | 37.8d | 39.3d | 40.9d | 41.8d | 43.4d | 41.3d | 40.6d | 39.4d | 38.4d | 39.0d | 38.7 | 40.2 | 40.6 | 38.7 | 41.1 | 43.8 | 45.7 | 47.8 | 45.8 | 48.1 | 45.8 | TBA |

| Public expenditured (% of GDP)[256] | — | — | 45.2d | 46.2d | 44.5d | 45.3d | 44.7d | 44.8d | 47.1d | 45.8d | 45.5d | 45.1d | 46.0d | 44.4d | 44.9 | 46.9 | 50.6 | 54.0 | 52.2 | 54.0 | 54.4 | 60.1 | 49.3 | 50.2 | 47.9 | TBA |

| Budget balanced (% of GDP)[34][257] | — | — | -14.2d | -9.1d | -6.7d | -5.9d | -3.9d | -3.1d | -3.7d | -4.5d | -4.9d | -5.7d | -7.6d | -5.5d | -6.1 | -6.7 | -9.9 | -15.3 | -11.1 | -10.2 | -8.7 | -12.3 | -3.5 | -2.1 | -2.2 | TBA |

| Structural balancee (% of GDP)[258] | — | — | −14.9f | −9.4g | −6.9g | −6.3g | −4.4g | −3.6g | −4.2g | −4.9g | −4.5g | −5.7h | −7.7h | −5.2h | −7.4h | −7.8h | −9.7h | −14.7h | −9.8 | −6.3 | -0.6 | 2.2 | 0.4 | -1.4 | -2.3 | TBA |

| Nominal GDP growth (%)[259] | 13.1 | 20.1 | 20.7 | 12.1 | 10.8 | 10.9 | 9.5 | 6.8 | 5.6 | 7.2 | 6.8 | 10.0 | 8.1 | 3.2 | 9.4 | 6.9 | 4.0 | −1.9 | −4.7 | −8.2 | −6.5 | −6.1 | −1.8 | -0.7 | 3.6 | TBA |

| GDP price deflatori (%)[260] | 3.8 | 19.3 | 20.7 | 9.8 | 7.7 | 6.2 | 5.2 | 3.6 | 1.6 | 3.4 | 3.5 | 3.2 | 3.0 | 2.3 | 3.4 | 3.2 | 4.4 | 2.6 | 0.8 | 0.8 | 0.1 | −2.3 | −2.6 | -1.2 | 0.7 | TBA |

| Real GDP growthj (%)[261][262] | 8.9 | 0.7 | 0.0 | 2.1 | 3.0 | 4.5 | 4.1 | 3.1 | 4.0 | 3.7 | 3.2 | 6.6 | 5.0 | 0.9 | 5.8 | 3.5 | −0.4 | −4.4 | −5.4 | −8.9 | −6.6 | −3.9 | 0.8 | 0.5 | 2.9 | TBA |

| Public debtk (billion €)[263][264] | 0.2 | 1.5 | 31.2 | 87.0 | 98.0 | 105.4 | 112.1 | 118.8 | 141.2 | 152.1 | 159.5 | 168.3 | 183.5 | 212.8 | 225.3 | 240.0 | 264.6 | 301.0 | 330.3 | 356.0 | 304.7 | 319.2 | 317.1 | 320.4 | 319.6 | TBA |

| Nominal GDPk (billion €)[259][265] | 1.2 | 7.1 | 45.7 | 93.4 | 103.5 | 114.8 | 125.7 | 134.2 | 141.7 | 152.0 | 162.3 | 178.6 | 193.0 | 199.2 | 217.8 | 232.8 | 242.1 | 237.4 | 226.2 | 207.8 | 194.2 | 182.4 | 179.1 | 177.8 | 184.3 | TBA |

| Debt-to-GDP ratio (%)[20][266] | 17.2 | 21.0 | 68.3 | 93.1 | 94.7 | 91.8 | 89.2 | 88.5 | 99.6 | 100.1 | 98.3 | 94.2 | 95.1 | 106.9 | 103.4 | 103.1 | 109.3 | 126.8 | 146.0 | 171.4 | 156.9 | 175.0 | 177.1 | 180.2 | 173.4 | TBA |

| - Impact of Nominal GDP growth (%)[267][268] | −2.3 | −3.7 | −10.6 | −10.0 | −9.1 | −9.3 | −7.9 | −5.7 | −4.7 | −6.7 | −6.3 | −9.0 | −7.1 | −2.9 | −9.2 | −6.7 | −3.9 | 2.1 | 6.3 | 13.0 | 12.0 | 10.1 | 3.3 | 1.3 | −6.3 | TBA |

| - Stock-flow adjustment (%)[259][267][269] | N/A | N/A | 2.9 | 1.5 | 3.9 | 0.5 | 1.4 | 1.9 | 12.1 | 2.7 | −0.3 | −0.8 | 0.3 | 9.2 | −0.4 | −0.4 | 0.3 | 0.0 | 1.9 | 2.1 | −35.1 | −4.4 | −4.7 | −0.2 | −2.6 | TBA |

| - Impact of budget balance (%)[34][257] | N/A | N/A | 14.2 | 9.1 | 6.7 | 5.9 | 3.9 | 3.1 | 3.7 | 4.5 | 4.9 | 5.7 | 7.6 | 5.5 | 6.1 | 6.7 | 9.9 | 15.3 | 11.1 | 10.2 | 8.7 | 12.3 | 3.5 | 2.1 | 2.2 | TBA |

| - Overall yearly ratio change (%) | −2.3 | −0.9 | 6.5 | 0.6 | 1.5 | −2.9 | −2.6 | −0.7 | 11.1 | 0.4 | −1.8 | −4.0 | 0.8 | 11.8 | −3.4 | −0.4 | 6.2 | 17.5 | 19.2 | 25.3 | −14.5 | 18.1 | 2.1 | 3.1 | −6.8 | TBA |

| Notes: a Year of entry into the Eurozone. b Forecasts by European Commission pr 5 May 2015.[94] c Forecasts by the bailout plan in April 2014.[44] d Calculated by ESA-2010 EDP method, except data for 1990–2005 only being calculated by the old ESA-1995 EDP method. e Structural balance = "Cyclically-adjusted balance" minus impact from "one-off and temporary measures" (according to ESA-2010). f Data for 1990 is not the "structural balance", but only the "Cyclically-adjusted balance" (according to ESA-1979).[270][271] g Data for 1995–2002 is not the "structural balance", but only the "Cyclically-adjusted balance" (according to ESA-1995).[270][271] h Data for 2003–2009 represents the "structural balance", but are so far only calculated by the old ESA-1995 method. i Calculated as yoy %-change of the GDP deflator index in National Currency (weighted to match the GDP composition of 2005). j Calculated as yoy %-change of 2010 constant GDP in National Currency. k Figures prior of 2001 were all converted retrospectively from drachma to euro by the fixed euro exchange rate in 2000. | ||||||||||||||||||||||||||

See also

[edit]- Anti-austerity movement in Greece

- European debt crisis

- Currency crisis

- List of countries by external debt

- List of countries by net international investment position per capita

- The role of the Institute of International Finance in the Greek debt crisis

- List of acronyms: European sovereign-debt crisis

- Puerto Rican government-debt crisis

- Vulture fund

- Japonica Partner's Greek bond trade

- Analogous events

- 1997 Asian financial crisis

- 1998 Russian financial crisis

- 1998–2002 Argentine great depression

- Latin American debt crisis

- List of sovereign debt crises

- South American economic crisis of 2002

- Film about the debt

Notes and references

[edit]- ^ "ECB Statistical Data Warehouse". sdw.ecb.europa.eu. Retrieved 2015-08-16.

- ^ "The Greek Depression" Foreign Policy

- ^ "Greece has a depression worse than Weimar Germany’s—and malaria too" Quartz

- ^ "[190] Thursday, Sept. 29: Keiser Report: The Greek Depression & Macing Bankers". Retrieved 29 June 2015.

- ^ http://www.iefimerida.gr/news/218032/bbc-i-ellada-vionei-anthropistiki-krisi-ennea-apokalyptika-grafimata-eikones

- ^ http://www.naftemporiki.gr/finance/story/928463/i-ellada-kai-i-anthropistiki-krisi

- ^ Higgins, Matthew; Klitgaard, Thomas (2011). "Saving Imbalances and the Euro Area Sovereign Debt Crisis" (PDF). Current Issues in Economics and Finance. 17 (5). Federal Reserve Bank of New York. Retrieved 11 November 2013.

- ^ George Matlock (16 February 2010). "Peripheral euro zone government bond spreads widen". Reuters. Retrieved 28 April 2010.

- ^ "Acropolis now". The Economist. 29 April 2010. Retrieved 22 June 2011.

- ^ "Greek/German bond yield spread more than 1,000 bps". Financialmirror.com. 28 April 2010. Retrieved 5 May 2010.[dead link]

- ^ "Gilt yields rise amid UK debt concerns". Financial Times. 18 February 2010. Retrieved 15 April 2011.

- ^ "Greece fails to make IMF payment as bailout expires". CTVNews. Retrieved 3 July 2015.

- ^ BBC News, 30 June 2015: Greece debt crisis: Eurozone rejects bailout appeal

- ^ a b c d e "Federal Reserve Bank San Francisco – Research, Economic Research, Europe, Balance of Payments, European Periphery". Federal Reserve Bank of San Francisco. 14 January 2013. Retrieved 3 July 2015.

- ^ a b c d "FRED Graph". stlouisfed.org. Retrieved 3 July 2015.

- ^ a b c Ezra Klein. "Greece's debt crisis explained in charts and maps". Vox.

- ^ Kashyap, Anil (June 29, 2015). "A Primer on the Greek Crisis" (PDF). Retrieved May 2016.

{{cite web}}: Check date values in:|accessdate=(help) - ^ a b c "Update of the Hellenic Stability and Growth Programme" (PDF). Greek Ministry of Finance. European Commission. 15 January 2010. Retrieved 9 October 2011.

- ^ "Onze questions-réponses sur la crise grecque". Nouvelobs.com. 5 May 2010.

- ^ a b "AMECO database results: General government consolidated gross debt (debt-to-GDP ratio, ESA 2010)". Automatically updated 3 times per year in February+May+November. European Commission. 7 November 2012.[permanent dead link]

- ^ "The Economic Adjustment Programme for Greece: Fifth Review – October 2011 (Draft)" (PDF). European Commission. Archived from the original (PDF) on 20 January 2012. Retrieved 22 October 2011.

- ^ "Revision of the Greek Government Deficit and Debt Figures" (PDF). Eurostat. 22 November 2004. Archived from the original (PDF) on 5 February 2012. Retrieved 5 March 2012.

- ^ "Report on Greek government deficit and debt statistics". European Commission. 8 January 2010. Retrieved 8 January 2010.

- ^ "Annual National Accounts: Revised data for the period 2005–2010" (PDF). Hellenic Statistical Authority. 5 October 2011. Archived from the original (PDF) on 12 November 2011. Retrieved 19 October 2011.

- ^ "Fiscal data for the years 2007–2010" (PDF). Hellenic Statistical Authority. 17 October 2011. Archived from the original (PDF) on 13 November 2011. Retrieved 17 October 2011.

- ^ "Papandreou Faces Bond Rout as Budget Worsens, Workers Strike". Bloomberg. 22 April 2010. Archived from the original on 23 June 2011. Retrieved 2 May 2010.

- ^ Staff (19 February 2010). "Britain's Deficit Third Worst in the World, Table". The Daily Telegraph. London. Retrieved 5 August 2011.

- ^ Melander, Ingrid; Papchristou, Harry (5 November 2009). "Greek Debt To Reach 120.8 Pct of GDP in '10 – Draft". Reuters. Retrieved 5 August 2011.

- ^ "Eurostat – Tables, Graphs and Maps Interface (TGM) table". europa.eu. Retrieved 3 July 2015.

- ^ "Greece: Foreign Capital Inflows Up". Embassy of Greece in Poland (Greeceinfo.wordpress.com). 17 September 2009. Retrieved 5 May 2010.

- ^ Takis Fotopoulos (1992). "Economic restructuring and the debt problem: the Greek case". International Review of Applied Economics, Volume 6, Issue 1 (1992), pp. 38–64.

- ^ a b "OECD Economic Outlook No.86 (Country debt and deficits)". Google Docs. December 2009. Retrieved 11 November 2012.

- ^ a b "OECD Economic Outlook No.91". OECD. 6 June 2012. Retrieved 11 November 2012.

- ^ a b c "AMECO database results: Net lending (+) or borrowing (-) of General Government -measured by EDP method (% of GDP, ESA 2010)". Automatically updated 3 times per year in February+May+November. European Commission. Retrieved 9 August 2012.[permanent dead link]

- ^ Directorate General for Research Economic Affairs Division (28 April 1998). "Briefing 22: EMU and Greece" (PDF). Task Force on Economic and Monetary Union (European Parliament).

- ^ Floudas, Demetrius A. "The Greek Financial Crisis 2010: Chimerae and Pandaemonium". Hughes Hall Seminar Series, March 2010: University of Cambridge.

{{cite news}}: CS1 maint: location (link) - ^ Dempsey, Judy (7 January 2013). "Military in Greece Is Spared Cuts". The New York Times.

- ^ "European Crisis Realities".

- ^ "Does Greece Need More Austerity?".

- ^ "Greeks and the state: An uncomfortable couple". Bloomberg Businessweek. 3 May 2010.

- ^ "State collected less than half of revenues due last year". Ekathimerini. 5 November 2013. Retrieved 7 November 2013.

- ^ a b c d "Corruption perception survey". Transparency International.

- ^ "Greece 'most corrupt' EU country, new survey reveals". BBC News. BBC. 5 December 2012. Retrieved 7 June 2015.

- ^ a b c d "The Second Economic Adjustment Programme for Greece (Fourth review April 2014)" (PDF). European Commission. 23 April 2014. Retrieved 17 May 2014.

- ^ "Corruption still alive and well in post-bailout Greece". Guardian. 3 December 2014. Retrieved 7 June 2015.

- ^ a b "Will Euro Austerity Push the Shadow Economy Even Deeper Into the Dark?". Bloomberg. 6 December 2012. Retrieved 8 January 2014.

- ^ "Greek Myths and Reality (p. 20)" (PDF). ELIAMEP. 6 August 2013. Archived from the original (PDF) on 8 January 2014. Retrieved 6 January 2014.

- ^ http://www.spiegel.de/international/europe/greece-and-switzerland-set-to-sign-tax-treaty-a-852526.html

- ^ "Greek minister slams Swiss over tax evasion". The Local ch. 24 June 2015.

- ^ "Swiss await Greek input on hidden billions". Swissinfo.ch. 25 February 2015.

- ^ https://www.nytimes.com/2017/02/18/world/europe/greece-bailout-black-market.html

- ^ http://www.dianeosis.org/en/2016/06/tax-evasion-in-greece/

- ^ http://www.keeptalkinggreece.com/2017/03/23/tax-evasion-in-greece-between-e11bn-e16bn-annually/

- ^ https://www.bloomberg.com/view/articles/2017-06-23/if-poland-can-fix-tax-fraud-so-can-greece

- ^ http://www.keeptalkinggreece.com/2017/03/23/tax-evasion-in-greece-between-e11bn-e16bn-annually/

- ^ a b c Μέχρι το τέλος του 2011 η συμφωνία για τη φορολόγηση των καταθέσεων στην Ελβετία [Deal to tax Swiss bank accounts to be reached by end of 2011] (in Greek). Skai TV. Retrieved 30 October 2011.

- ^ "Greek minister slams Swiss over tax evasion". The Local ch. 24 June 2015.

- ^ "Swiss await Greek input on hidden billions". Swissinfo.ch. 25 February 2015.

- ^ http://europa.eu/rapid/press-release_MEMO-16-3185_en.htm

- ^ http://www.tornosnews.gr/en/greek-news/economy/26979-tax-evasion-safari-in-greek-tourist-spots-snags-major-violators.html

- ^ "Fin Ministry Bill Gives Tax Breaks to Greeks Making Payments With Credit and Debit Cards". 13 December 2016. Retrieved 28 August 2017.

- ^ "WORLD EUROPE Why Greeks' swap of cash for cards could end a culture of tax evasion". The Christian Science Monitor. 11 April 2016. Retrieved 28 August 2017.

- ^ http://www.ekathimerini.com/220705/article/ekathimerini/business/clear-incentives-for-greater-card-use

- ^ Andrew Willis (26 January 2010). "Greek bond auction provides some relief". EU Observer. Retrieved 15 April 2011.

- ^ "Strong demand for 10-year Greek bond". Financial Times. 4 March 2010. Retrieved 2 May 2010.

- ^ a b "Greece's sovereign-debt crisis: Still in a spin". The Economist. 15 April 2010. Retrieved 2 May 2010.

- ^ "Quarterly National Accounts: 3rd Quarter 2014 (Flash Estimates) and revised data 1995 Q1-2014 Q2" (PDF). Hellenic Statistical Authority (ELSTAT). 14 November 2014. Archived from the original (PDF) on 14 November 2014.

- ^ Wachman, Richard; Fletcher, Nick (27 April 2010). "Standard & Poor's downgrade Greek credit rating to junk status". The Guardian. Retrieved 27 April 2010.

- ^ "Europe and IMF Agree €110 Billion Financing Plan with Greece". IMF Survey online. May 2, 2010. Retrieved June 28, 2015.

- ^ "EU Stats Office: Greek Economy Figures Unreliable". ABC News. 12 January 2010. Archived from the original on October 2010. Retrieved 2 May 2010.

{{cite web}}: Check date values in:|archivedate=(help) - ^ Andrew Wills (5 May 2010). "Rehn: No other state will need a bail-out". EU Observer. Retrieved 6 May 2010.

- ^ Story, Louise; Thomas, Landon Jr.; Shwartz, Nelson D. (13 February 2010). "Wall St. Helped to Mask Debt Fueling Europe's Crisis". The New York Times. Retrieved 6 May 2010.

- ^ Nicholas Dunbar; Elisa Martinuzzi (March 5, 2012). "Goldman Secret Greece Loan Shows Two Sinners as Client Unravels". Bloomberg.

Greece actually executed the swap transactions to reduce its debt-to-gross-domestic-product ratio because all member states were required by the Maastricht Treaty to show an improvement in their public finances," Laffan said in an e- mail. "The swaps were one of several techniques that many European governments used to meet the terms of the treaty."

- ^ Elena Moya (16 February 2010). "Banks that inflated Greek debt should be investigated, EU urges". The Guardian.

"These instruments were not invented by Greece, nor did investment banks discover them just for Greece," said Christophoros Sardelis, who was chief of Greece's debt management agency when the contracts were conducted with Goldman Sachs. Such contracts were also used by other European countries until Eurostat, the EU's statistic agency, stopped accepting them later in the decade. Eurostat has also asked Athens to clarify the contracts.

- ^ a b Beat Balzli (February 8, 2010). "Greek Debt Crisis: How Goldman Sachs Helped Greece to Mask its True Debt". Der Spiegel. Retrieved 29 October 2013.

This credit disguised as a swap didn't show up in the Greek debt statistics. Eurostat's reporting rules don't comprehensively record transactions involving financial derivatives. "The Maastricht rules can be circumvented quite legally through swaps," says a German derivatives dealer. In previous years, Italy used a similar trick to mask its true debt with the help of a different US bank.

- ^ a b "Greece Paid Goldman $300 Million To Help It Hide Its Ballooning Debts". Business Insider. Archived from the original on 5 March 2010. Retrieved 6 May 2010.

- ^ Louise Story; Landon Thomas Jr; Nelson D. Schwartz (February 13, 2010). "Global Business: Wall St. Helped to Mask Debt Fueling Europe's Crisis". The New York Times.

In dozens of deals across the Continent, banks provided cash upfront in return for government payments in the future, with those liabilities then left off the books. Greece, for example, traded away the rights to airport fees and lottery proceeds in years to come.

- ^ Balzli, Beat (2 August 2010). "How Goldman Sachs Helped Greece to Mask its True Debt". Der Spiegel. Retrieved 1 August 2012.

- ^ Story, Louise; Thomas Jr, Landon; Schwartz, Nelson D. (14 February 2010). "Wall St. Helped To Mask Debt Fueling Europe's Crisis". The New York Times. Retrieved 6 May 2010.

- ^ "Report on Greek government deficit and debt statistics" (PDF). European Commission. 8 January 2010. Retrieved 22 January 2014.

- ^ "Greek debt to reach 120.8 pct of GDP in '10 – draft". Reuters. 5 November 2009. Retrieved 2 May 2010.

- ^ "Eurostat Newsrelease 170/2010: Provision of deficit and debt data for 2009 – Second notification" (PDF). Eurostat. 15 November 2010. Retrieved 19 February 2012.

- ^ "Report on the EDP methodological visits to Greece in 2010" (PDF). Eurostat. 15 November 2010. Archived from the original (PDF) on 16 September 2011. Retrieved 19 February 2012.

- ^ "Greece's revised 2009 deficit tops 15% of GDP: Eurostat lifts reservations over Greek methodology". MarketWatch. 15 November 2010. Retrieved 19 February 2012.

- ^ "Greek debt write-down must be larger: German finance minister". Reuters. 16 October 2011.

- ^ Landon, Thomas (5 November 2011). "The Denials That Trapped Greece". The New York Times.

- ^ Landon, Thomas (5 November 2011). "The Denials That Trapped Greece". The New York Times.

- ^ "The Greek debt restructuring: an autopsy" (PDF). Oxford Journals. 1 July 2013.

- ^ a b "Βενιζέλος: Δημιουργία λογαριασμού κοινωνικής εξισορρόπησης" [Venizelos: Creation of a social balace account.]. Skai TV. 17 October 2011. Retrieved 17 October 2011.

- ^ Natalie Weeks (20 May 2011). "Greece Must Speed Up Asset Sales, Win Investment, Minister Says". Bloomberg.com.

- ^ Greece backtracks on privatisation, Financial Times

- ^ "Occasional Papers 192: The Second Economic Adjustment Programme for Greece. Fourth Review, April 2014" (PDF). Table 11. Greece Financing Needs 2012–2016. European Commission. 18 June 2014.

- ^ "IMF Country Report No. 14/151: Greece – Fifth Review under the Extended Arrangement under the Extended Fund Facility, and Request for Waiver of Nonobservance of Performance Criterion and Rephasing of Access; Staff Report; Press Release; and Statement by the Executive Director for Greece" (PDF). Table 14. Greece: State Government Financing Requirements and Sources, 2013–16. IMF. 9 June 2014.

- ^ a b "European economic forecast – spring 2015". European Commission. 5 May 2015.

- ^ "Greek economy to grow by 2.9 pct in 2015, draft budget". Newsbomb.gr. 6 October 2014.

- ^ "Greece plans new bond sales and confirms growth target for next year". Irish Independent. 6 October 2014.

- ^ "Press release: Quarterly National Accounts – 1st Quarter 2015 (Provisional Data)" (PDF). ELSTAT. 29 May 2015. Archived from the original (PDF) on 30 May 2015.

- ^ "ELSTAT confirms return to recession". Kathimerini (Reuters). 29 May 2015.

- ^ "IMF suspends aid to Greece ahead of new elections". Kathimerini. 29 December 2014.

- ^ "Eurogroup statement on Greece (20 February 2015)". Council of the European Union. 20 February 2015.

- ^ "Master Financial Assistance Facility Agreement (MFFA)" (PDF). EFSF. 27 February 2015.

- ^ "Greece creditors say no deal near as G-7 frustration vented". Kathimerini (Bloomberg). 29 May 2015.

- ^ "Greece locked in talks with creditors as payment clock ticks". Kathimerini (Bloomberg). 30 May 2015.

- ^ "Greece, creditors line up rival reform proposals to unlock aid". Kathimerini (Reuters). 2 June 2015.

- ^ a b "Greek bailout talks to continue, debt relief to be discussed after program implemented". Kathimerini. 22 June 2015.

- ^ "As debt deadline looms, which way will Greece go?". Kathimerini (Reuters). 12 June 2015.

- ^ "Fearful ECB starts countdown on Greek funding lifeline". Kathimerini (Reuters). 12 June 2015.

- ^ "Greek negotiators learned of referendum proposal from Twitter". Kathimerini (Bloomberg). 28 June 2015.

- ^ a b "Eurogroup statement on Greece". Council of the European Union. 27 June 2015.

- ^ "European Commission – Press release: Information from the European Commission on the latest draft proposals in the context of negotiations with Greece". European Commission. 28 June 2015.

- ^ a b "Remarks by Eurogroup President at the intermediary Eurogroup press conference on 27 June 2015" (PDF). Council of the European Union. 27 June 2015.

- ^ "Greece debt crisis: Tsipras announces bailout referendum". BBC News. 27 June 2015.

- ^ Udland, Myles (28 June 2015). "REPORT: Greece's stock market will be closed for at least a week". Business Insider. Retrieved 1 July 2015.

- ^ Βενιζέλος: "Αντισυνταγματικό το δημοψήφισμα!" (in Greek). Emea. 27 June 2015.

- ^ "Eurogroup meeting – Press Conference: Saturday, 27 June 2015 at 17:15 CET". Council of the European Union. 27 June 2015.