Talk:Virtual currency

| This article is rated C-class on Wikipedia's content assessment scale. It is of interest to the following WikiProjects: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| It is requested that a template-based chart or charts be included in this article to improve its quality. Useful templates may be found in Category:Chart, diagram and graph formatting and function templates. Specific illustrations, plots or diagrams can be requested at the Graphic Lab. For more information, refer to discussion on this page and/or the listing at Wikipedia:Requested images. (March 2014) |

Broad-concept article, etc.

[edit]Sure that would be nice. I don't exactly disagree with the essence of this for instance, but I can't find any sources to make those comparisons and WP:OR is policy. I'll also note that before 2013, virtual currency was unambiguously or at least overwhelmingly referring to the virtual econ stuff (did a search in Google Books). But all has changed with the 2013 bitcoin craze. Like it or not (and the bitcoin fans certainly don't like it [1]), most of the mainstream press has decided to use "virtual currency" to refer to the crypocurrencies. It may be possible turn this into a broad-concept article in the future though. Someone not using his real name (talk) 05:32, 26 December 2013 (UTC)

- The concept is either ambiguous, or it is not. I think an article can be written on the topic as a whole, and it is therefore not ambiguous. bd2412 T 23:40, 28 December 2013 (UTC)

diagram

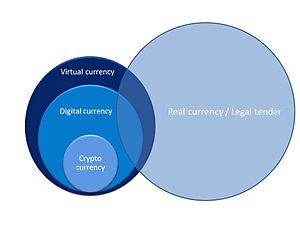

[edit]I wrote up the article, and think it needs a Venn diagram illustrating relationships with related terms digital currency and cryptocurrency. I have created one, but it is too big- can anyone help to make it smaller so it shows up right side of the last section? (removed image) Thank you.--Wuerzele (talk) 06:36, 28 March 2014 (UTC)

- From Wikipedia:Extended_image_syntax, Specify the width using <number>px, for example [[File:Virtual currency relationships.jpg|right|300px|alt=Virtual currency relationships]] gives:

- Not sure if the diagram is correct or correct in all jurisdictions. Also, what is the difference between virtual and digital (Edit: virtual = not legal tender?)Jonpatterns (talk) 15:13, 1 April 2014 (UTC)

- Jonpatterns Thank you. (I didnt see the reply, because you didnt ping me.) The difference between virtual and digital currency is only that a digital currency is a special subtype of a virtual currency. no virtual currencies are convertible to legal tender, even reward programs. Digital and cryptocurrencies definitely arent legal tender. You are right virtual isnt legal tender and thus shouldnt overlap.--Wuerzele (talk) 03:40, 15 April 2014 (UTC)

- @Wuerzele: Thanks for the reply. I wonder if cryptocurrencies in the future might be legal tender, the is talk of Germany having some recognition of Bitcoin. Jonpatterns (talk) 08:57, 15 April 2014 (UTC)

- Jonpatterns Thank you. (I didnt see the reply, because you didnt ping me.) The difference between virtual and digital currency is only that a digital currency is a special subtype of a virtual currency. no virtual currencies are convertible to legal tender, even reward programs. Digital and cryptocurrencies definitely arent legal tender. You are right virtual isnt legal tender and thus shouldnt overlap.--Wuerzele (talk) 03:40, 15 April 2014 (UTC)

- The ECB book contains a table. Please note that it contradicts this. Ladislav Mecir (talk) 06:34, 9 August 2014 (UTC)

I see several contradictions between User:Wuerzele Venn diagram and the current article (as of 11 May 2021):

- the term „virtual currency“ is used for a digital currency that is not real currency and unregulated

- the term „E-money“ is used for a digital currency that is legal tender and regulated

- cryptography is a technology that is key to a decentralised digital currency, unregulated (this is clear from the table but unfortunately not the disambiguations to this Wiki article) or regulated (?)

I agree with User:Ladislav Mecir that the table in the Wikipedia article adequately defines the terms and this talk section with its Venn diagram can be deleted. What is not clearly shown in the table is the relationship to the concepts of currency flow. Adding (double pointed) arrows to indicate possible conversions might help illustrate.

virtual vs digital

[edit]The problem with this diagram and with the page is that the use of the term virtual is used elsewhere in computer science with a specific meaning in contrast with "real". Virtual currency is a term that is used by people with no expertise in the use of the term in technology subjects (such as virtual reality, virtual memory, virtual disk, virtual machine) and it is used solely as a synonym for "digital" or "online". I suggest that the usage of the term virtual currency is inconsistent with the meaning defined by relevant authorities (technology experts). That said there certainly are virtual currencies, currencies in virtual worlds fit this well. link 220.237.43.107 (talk) 10:51, 1 June 2014 (UTC)

- the link is useful but not the full story. for example, virtual can mean a currency that has some aspects associated with money, but not all. how do you suggest improving the article? a mention of game vs simulated might be useful.Jonpatterns (talk) 11:50, 1 June 2014 (UTC)

- hi, I put the the money matrix from the ECB report to the article. I think that there is some logic to the definition of "digital currency" in the ECB report - it is a form that is electronically created and stored. At the first sight that points to "electronic currency", but "electronic currency" is a legal term already used and defined in many jurisdictions, and as such it has another property than just being electronically created and stored (it is regulated). 220.237.43.107 is right that the term "virtual currency" would be best suited to refer to a currency in a virtual economy. ECB, when defining the terminology starts with the notion of "virtual community", which they illustrate by examples such as wikipedians, facebook users, etc... Later on, the report states that (some) virtual communities use currencies, which they call "virtual currencies" because of that. The fact is that it is possible to speak and reason about bitcoin users, considering them a "virtual community". However, as 220.237.43.107 noted, a more appropriate term appears to be "online community" leading to a more appropriate term "online currency", leaving the term "virtual currency" usable for currencies in virtual economies. Ladislav Mecir (talk) 07:31, 12 August 2014 (UTC)

Virtual currency can be physical?

[edit]The article lede states that the term 'virtual currency' was coined ; -) around at the same time as 'digital currency', and its key feature is non legal tender (and possibly not fulfilling the three function of real currencies). The last section says 'virtual currency' can refer to physical currencies - is this being applied in retrospect, considering the term is new? Jonpatterns (talk) 15:48, 18 April 2014 (UTC)

- No. --Wuerzele (talk) 04:55, 2 May 2014 (UTC)

- Jonpatterns, thanks for the message, which i didn’t see until now. good point. the contradiction stems from the 2 definitions I used, the US Treasury and the Europ Centr Bank : 'virtual currency' can refer to physical currencies per ECB –the booklet is an easy read and really informative.-whereas Treasury doesn’t say so. i will clarify the text to reflect your observation.

- Hi Jonpatterns I rephrased and attributed ECB and Fin CEN refs, removed citation needed flag, fyi. let me know about or fix any remaining murkiness plse. --Wuerzele (talk) 18:39, 11 May 2014 (UTC)

edits on origin of term virtual currency

[edit]I had written "originally coined in 2011", because this was the earliest article with the term virtual currency I could find.

The sentence was reverted twice by Stan2525 and reads now as: "Virtual currency originates in the late 1990s, with the creation of the Internet currency Flooz in 1999". That statement requires a source. The Chicago Tribune article ( my source) does not say that.

The earliest article I found USING the term virtual currency today are from 2009. This would correspond to the fact that this article was suggested in 2010 (but never written- I did). I will restore the original sentence in a modified form.--Wuerzele (talk) 06:20, 27 May 2014 (UTC)

- beenz apparently predates Flooz by one year. Beenz came out in 1998 and Flooz came out in 1999. --Stan2525 (talk) 18:42, 27 July 2014 (UTC)

- Stan2525, again: do you have reliable sources for these claims?--Wuerzele (talk) 06:30, 10 August 2014 (UTC)

Regulatory challenges section

[edit]I had mentioned the original list

- data collection (or monitoring) for Economic Statistics

- analysis re Monetary and Exchange Rate Policy

- policy formation re tax leakage

- regulation re Payment Systems and Settlement Infrastructure

- supervision,aka Consumer protection

- enforcement re Anti-money laundering

- resolution re Impact on Regulated Financial Service Providers

217.112.145.202 suggested to leave out the concrete examples, and finally

66.76.194.130 removed the abstract termsand left the concrete examples !

- Economic Statistics

- Monetary and Exchange Rate Policy

- Tax Leakage

- Payments Systems and Settlement Infrastructure

- Consumer Protection

- Anti-Money Laundering

- Impact on Regulated Financial Service Providers

Great, we have all 3 opinions. can we discuss which one to keep? --Wuerzele (talk) 08:28, 8 July 2014 (UTC)

Distinction from digital currency and cryptocurrency

[edit]In the "Definitions" section of the article and in the lead, there is a definition of the virtual currency term claiming that 'the European Central Bank defined it as "a type of unregulated, digital money, which is issued and usually controlled by its developers, and used and accepted among the members of a specific virtual community' supported by a citation. This claim states that every virtual currency is, by the cited definition, a digital currency.

Contradicting this definition is the formulation: 'A cryptocurrency is a particular type of a digital currency, and both are virtual currencies.' Since this claim is unsupported by a reliable source (it actually contradicts the one given), I consider it WP:OR.Ladislav Mecir (talk) 15:39, 8 August 2014 (UTC)

- Thanks for the comment, Ladislav. Sorry, I fail to see the contradiction.

- virtual currency = type of digital currency per ECB

- cryptocurrency =encrypted type of digital currency, then cryptocurrency =virtual currency

- I accept, that I didnt deliver a source for a def of cryptocurrency. Thats because there s just no good source. This report by the Law Library of Congress that surveyed 40 jurisdictions and the EU (ref 147 on Bitcoin) showed there's no clear definition or of digital currencies. Its worse finding a def of cryptocurrency.

- --Wuerzele (talk) 06:16, 10 August 2014 (UTC)

- To clarify what the contradiction is: there is no problem saying that a cryptocurrency is a virtual currency, that is compatible with the source. It is however a problem when it is stated that a digital currency is a virtual currency, that is contradicting the source. Ladislav Mecir (talk) 06:52, 10 August 2014 (UTC)

- Ladislav Mecir Thanks for working on the section. It is more accurate and improved by a source for cryptocurrency. Is it easier to undertstand though? I dont think so. It got more complicated and longer.

- To clarify what the contradiction is: there is no problem saying that a cryptocurrency is a virtual currency, that is compatible with the source. It is however a problem when it is stated that a digital currency is a virtual currency, that is contradicting the source. Ladislav Mecir (talk) 06:52, 10 August 2014 (UTC)

- I think I understand what you meant by contradiction now. You mainly meant to say claim is unsupported by a reliable source- as you said above. I wouldnt use the word contradiction in this context, so I was confused. Thanks again.--Wuerzele (talk) 02:54, 11 August 2014 (UTC)

- @Wuerzele: - I shall attempt to explain the situation more thoroughly in hope that it helps. Note that your diagram contradicts the "Money matrix" table that can be found at page #11 of the Virtual currency schemes book. I observed that the contradiction was also present in the text of the "Distinction from digital currency and cryptocurrency" section, describing the situation as depicted in your diagram and contradicting the definitions in the book. That is why I used the term "contradicts the source" and not the formulation "unsupported by reliable source". Ladislav Mecir (talk) 06:48, 11 August 2014 (UTC)

- Thanks for the source, Section #2 starts on page 14. Jonpatterns (talk) 16:57, 11 August 2014 (UTC)

- FYIJonpatterns, the source is the main source on which I based the virtual currency page and the Bitcoin#Legal Status and Regulation section.--Wuerzele (talk) 20:20, 12 August 2014 (UTC)

- Great stuff, I have not looked at the sources for a while so not familiar with what was already there.Jonpatterns (talk) 20:39, 12 August 2014 (UTC)

- FYIJonpatterns, the source is the main source on which I based the virtual currency page and the Bitcoin#Legal Status and Regulation section.--Wuerzele (talk) 20:20, 12 August 2014 (UTC)

- Ladislav Mecir, thanks for not giving up on me -:) Table 1, the ECB's money matrix has only 2 "overlaps" so to speak, in analogy to the Venn diagram I chose: digital currency with physical currency (legality), and virtual currency with digital currency (non-physicality). This corresponds to the overlaps in the Venn diagram and I see no contradiction to the source.

- The money matrix however, falls short of 2 aspects: cryptocurrency altogether, and those forms of virtual currency that are legal/regulated (coupons, money paid for online services, etc), since in the matrix virtual currency is all in the unregulated corner. Id say the matrix is contained in, but cant be compared to the working diagram (which BTW isnt part of the article). glad you are discussing it. Please draw a diagram the way you think it should look. Cordially,--Wuerzele (talk) 20:45, 12 August 2014 (UTC)

- @Wuerzele: - you wrote: 'Table 1, the ECB's money matrix has only 2 "overlaps" so to speak, in analogy to the Venn diagram I chose: digital currency with physical currency' - hmm, either I do not understand what you mean or there is some other kind of misunderstanding. In my opinion, the "money matrix" does no show any "overlap" between physical and digital format. May I bother you to explain it to me? That being said, your Venn diagram suggests that every digital currency is also virtual, which is not true according to the "money matrix". (according to the "money matrix" e-money are digital, but they are not virtual, which your Venn diagram rules off, and that is not the only incompatibility between the "money matrix" and your Venn diagram I see) You are right that the "money matrix" does not cover cryptocurrencies at all. As for the other shortcoming you mention, that looks as a misunderstanding to me as well. Regarding the fact that your Venn diagram is not a part of the article - agreed, but the text I replaced actually suggested the relations like: "every digital currency is a virtual currency" (which is depicted in your Venn diagram but contradicts the "money matrix" and the text of the ECB report as I noted). To improve the situation, I added cryptocurrencies to the money matrix table, which I put into the article. Ladislav Mecir (talk) 22:04, 12 August 2014 (UTC)

- Ladislav Mecir, a 2 by 2 table (which the money matrix is, essentially) takes (presence or absence of) 2 dichotomous characteristics to define/classify 4 items. That is, only 2 out of 4 cells can have both characteristics (which I called "overlap"). But the Venn diagram can show x characteristics, and they dont have to be dichotomous, that's why I picked it. The article section attempts to show the difference of 3 similar currency terms, which would require 6 fields in a matrix. Virtual currency is not all unregulated and a future virtual and cryptocurrency in Ecuador would be regulated- but neither of these 2 cases fits into the ECB money matrix. - I agree that not all digital currencies are virtual currencies. Also I would add a source to teh table stating "modified from".... --Wuerzele (talk) 07:04, 13 August 2014 (UTC)

- @Wuerzele: - the table is very practical, since it is easy to adapt if/when needed. Regarding your "virtual currency is not all unregulated" note. That is interesting, and a good subject to discussion. However, the ECB book defined virtual currency as unregulated, as you can see checking the definition, i.e., there is no "regulated virtual currency" according to the book. Regarding the future cryptocurrency in Ecuador - according to the definition by ECB it will be a regulated legal tender, i.e., not a virtual currency. However, notice the empty box in the money matrix, we can easily put in the centralized cryptocurrency of Ecuador when needed. The attribution note is a good idea, done. Ladislav Mecir (talk) 08:15, 13 August 2014 (UTC)

- Ladislav Mecir, yes, the table may be practical, but you have to admit: it looks more and more complicated. And it doesnt even include the coupon, an ECB example of a physical virtual currency...Thanks for working on all this.--Wuerzele (talk) 05:16, 14 August 2014 (UTC)

- @Wuerzele: - the table is very practical, since it is easy to adapt if/when needed. Regarding your "virtual currency is not all unregulated" note. That is interesting, and a good subject to discussion. However, the ECB book defined virtual currency as unregulated, as you can see checking the definition, i.e., there is no "regulated virtual currency" according to the book. Regarding the future cryptocurrency in Ecuador - according to the definition by ECB it will be a regulated legal tender, i.e., not a virtual currency. However, notice the empty box in the money matrix, we can easily put in the centralized cryptocurrency of Ecuador when needed. The attribution note is a good idea, done. Ladislav Mecir (talk) 08:15, 13 August 2014 (UTC)

- Ladislav Mecir, a 2 by 2 table (which the money matrix is, essentially) takes (presence or absence of) 2 dichotomous characteristics to define/classify 4 items. That is, only 2 out of 4 cells can have both characteristics (which I called "overlap"). But the Venn diagram can show x characteristics, and they dont have to be dichotomous, that's why I picked it. The article section attempts to show the difference of 3 similar currency terms, which would require 6 fields in a matrix. Virtual currency is not all unregulated and a future virtual and cryptocurrency in Ecuador would be regulated- but neither of these 2 cases fits into the ECB money matrix. - I agree that not all digital currencies are virtual currencies. Also I would add a source to teh table stating "modified from".... --Wuerzele (talk) 07:04, 13 August 2014 (UTC)

- @Wuerzele: - you wrote: 'Table 1, the ECB's money matrix has only 2 "overlaps" so to speak, in analogy to the Venn diagram I chose: digital currency with physical currency' - hmm, either I do not understand what you mean or there is some other kind of misunderstanding. In my opinion, the "money matrix" does no show any "overlap" between physical and digital format. May I bother you to explain it to me? That being said, your Venn diagram suggests that every digital currency is also virtual, which is not true according to the "money matrix". (according to the "money matrix" e-money are digital, but they are not virtual, which your Venn diagram rules off, and that is not the only incompatibility between the "money matrix" and your Venn diagram I see) You are right that the "money matrix" does not cover cryptocurrencies at all. As for the other shortcoming you mention, that looks as a misunderstanding to me as well. Regarding the fact that your Venn diagram is not a part of the article - agreed, but the text I replaced actually suggested the relations like: "every digital currency is a virtual currency" (which is depicted in your Venn diagram but contradicts the "money matrix" and the text of the ECB report as I noted). To improve the situation, I added cryptocurrencies to the money matrix table, which I put into the article. Ladislav Mecir (talk) 22:04, 12 August 2014 (UTC)

- Thanks for the source, Section #2 starts on page 14. Jonpatterns (talk) 16:57, 11 August 2014 (UTC)

- @Wuerzele: The table looks more complicated because it lists more and more characteristics. (the last added was the centralized/decentralized characteristic) That is unavoidable if we want to keep all the characteristics in one table (that is not necessary, we can subdivide the table if we prefer to replace it by two or more simpler tables). As for the physical coupon, the ECB does say that it is a precursor of virtual currency, not that it is a virtual currency. That makes sense, since their definition of virtual currency rules off physical coupons. On the other hand, coupons may be digital, and then they should be listed as examples of centralized virtual currency. I add them to the matrix. I have got yet another question for you. As an example, take the cell describing decentralized unregulated physical currencies. The cell is empty, since there are no such currencies. Would you prefer to put "N.A." to the cell? Ladislav Mecir (talk) 07:45, 14 August 2014 (UTC)

- Ladislav Mecir ok, n.a. thanks--Wuerzele (talk) 02:59, 15 August 2014 (UTC)

- I cleaned up the table a little bit by removing some extra cells (I needed to use Libre Office to detect the extra cells) and I decided to use a more proper third dimension instead of the "inner headers" that are "Virtual" and "currency" (with a lowercase and which is improper, since the rest are currencies too). I used the same blue shade as in the ECB. I also added a mention to cash and capitalised the Money Matrix - I think it deserves it. The only regression is the lack of an indicator or what blue means without information out of the table. This new table will be present in a forthcoming e-book titled Monero Handbook.--

David Latapie (✒ | @) — www 16:46, 1 February 2015 (UTC)

- @Wuerzele: The table looks more complicated because it lists more and more characteristics. (the last added was the centralized/decentralized characteristic) That is unavoidable if we want to keep all the characteristics in one table (that is not necessary, we can subdivide the table if we prefer to replace it by two or more simpler tables). As for the physical coupon, the ECB does say that it is a precursor of virtual currency, not that it is a virtual currency. That makes sense, since their definition of virtual currency rules off physical coupons. On the other hand, coupons may be digital, and then they should be listed as examples of centralized virtual currency. I add them to the matrix. I have got yet another question for you. As an example, take the cell describing decentralized unregulated physical currencies. The cell is empty, since there are no such currencies. Would you prefer to put "N.A." to the cell? Ladislav Mecir (talk) 07:45, 14 August 2014 (UTC)

Curbing anonymity

[edit]Wuerzele wrote: "...curbing anonymity is also argued to protect consumers, not ONLY mentioned by critics" - I read the cited sources, and found that critics mention it as a negative of the proposal. The purported "curbing anonymity would protect consumers" opinion is not present in the sources, though. Therefore, it is just a matter of WP:NOR for me. Ladislav Mecir (talk) 20:40, 6 October 2014 (UTC)

- Ladislav, thank you for going over this with a fine comb. you are correct the source I quoted didnt argue curbed anonymity protects consumers. Mea culpa. (it is not WP:OR, but I read too many different sources, opinions). I just inserted a quote from the DFS press release, in which the regulator talks of the loss of anonymity in conjunction with anti money laundering, striking a balance for the common good. I hope this helps to explain why I think the article must not just portray curbed anonymity as a criticism, and should stay at the beginning. Let me know.--Wuerzele2 (talk) 21:04, 8 October 2014 (UTC)

Increasing centralization over the years

[edit]This part, which Wuerzele reinserted is not supported by the cited material and I consider it a matter of the WP:NOR policy. As opposed to that, the rest of the sentence is supported by the cited source. Ladislav Mecir (talk) 20:47, 6 October 2014 (UTC) Ah, Wuerzele already added a source to "increasing centralization". However, US Treasury presents a definition of decentralization: "...have no central repository and no single administrator", and this definition is not changing in time. Ladislav Mecir (talk) 21:02, 6 October 2014 (UTC)

- Ladislav, do you object to the sentence as it is now? The (admittedly arbitrary) definition of centralization by the US Treasury not withstanding, increasing centralization has been echoed from many information sources since 2013. So, even if everyday-use of the term centralization is slightly different from the US Treasury, it is still something the wikipedia article should inform about. I quoted Forbes, a WP:reliable source, so I think this should be ok. I also like that the Forbes article elaborates a bit on the meaning of increasing centralization. Your thoughts?- ping me at my "travel address" , I didnt see your posts until today.--Wuerzele2 (talk) 20:24, 8 October 2014 (UTC)

- I think that the present wording is OK. On the other hand, I saw sources presenting the opinion that mining pools (regardless of the size) cannot do anything that would go against the will of their members (otherwise the members would immediately leave the pool). Thus, the centralization, according to opponents of the opinion you put into the article, is not increasing in a way worth noting. Also, the definition of decentralization by US Treasury has many supporters, and a balanced view should be that some think centralization is increasing, while others don't think there is any noteworthy change. Ladislav Mecir (talk) 21:12, 8 October 2014 (UTC)

- Fair enough. Please, feel free to insert the sources for "others who don't think there is any noteworthy change".--Wuerzele2 (talk) 09:20, 9 October 2014 (UTC)

- I think that the present wording is OK. On the other hand, I saw sources presenting the opinion that mining pools (regardless of the size) cannot do anything that would go against the will of their members (otherwise the members would immediately leave the pool). Thus, the centralization, according to opponents of the opinion you put into the article, is not increasing in a way worth noting. Also, the definition of decentralization by US Treasury has many supporters, and a balanced view should be that some think centralization is increasing, while others don't think there is any noteworthy change. Ladislav Mecir (talk) 21:12, 8 October 2014 (UTC)

Ven as an example of a currency with flow into one direction

[edit]@Kaskaad: The claim is dubious, since the Ven (currency) article mentions that "It trades against major currencies at floating exchange rates." Please correct either the Ven (currency) article, the marked claim in this article, or please explain why there is no contradiction. Ladislav Mecir (talk) 12:32, 21 November 2014 (UTC)

Purportedly "terse" definition

[edit]The lead section states: "The US Department of Treasury in 2013 defined it more tersely..." That is contradicting the cited source. The complete definition is cited in the "Definitions" section and is significantly longer than the definition by ECB. Ladislav Mecir (talk) 23:52, 18 December 2014 (UTC)

- Hi Ladislav , to be honest, I do not agree with your move from December 19. First, the lede needs to reflect what's written the body, so you could have added something you felt was missing in the lede, but moving? no. On all WP pages there is an inherent, small amount of duplication between WP:lede and body. Second, I disagree with the valuation in your edit summary ("move the definitions of the term to the lead section instead of using imprecise copies") -The def was not imprecise -incomplete of course !- summarizing appropriately is the freedom of an editor, to take the part one thinks is enough. The obvious remedy there would have been to make what you call an imprecise copy precise, again, instead of moving.

- Third, a good definition section in the body is WELL justified, IMO essential in this complicated subject.

- Fourth, you made the lede wholly reference-dependent. I always strive to keep refs out of the lede because they arrest reading, make editing more visually difficult. I do not see the point of refs in the lede, as the lede is only an overview.Oh, and if you were hung up on the word "tersely", you could have just taken that out. As a result of the changes, the second sentence in the lede is now bloated with offtopic stuff preceding the actual definition(!) and comes across as lawyerese gibberish now, so bad that one (I for one) doesnt want to read on:

In 2013, Financial Crimes Enforcement Network (FinCEN), a bureau of the US Treasury, in contrast to its regulations defining currency as "the coin and paper money of the United States or of any other country that [i] is designated as legal tender and that [ii] circulates and [iii] is customarily used and accepted as a medium of exchange in the country of issuance" (also called "real" currency by FinCEN), defined virtual currency as "a medium of exchange that operates like a currency in some environments, but does not have all the attributes of real currency"

--Wuerzele (talk) 22:43, 5 February 2015 (UTC)

- "summarizing appropriately is the freedom of an editor, to take the part one thinks is enough" - the removal of a half of the definition is not "summarizing". It creates a distinct definition. The fact is that the regulatory text by FinCEN defines the regulatory notion of the real currency in order to use it in the subsequent definition of the virtual currency. The removal of the regulatory definition of the real currency from the text has the same effect as if the regulatory definition was replaced by the common definition of the notion, which means that it substantially changes the meaning of the text.

- Re "comes across as lawyerese gibberish" - I respect your right to perceive the text of the FinCEN's regulation as "lawyerese gibberish", but that does not give you any right to distort its meaning. Ladislav Mecir (talk) 23:54, 6 February 2015 (UTC)

- YOu were the one insisting on full length definitions in the lede. As a conmpromise I left them there but took out what distracted. I see your point and will place [..] in its place. And yes, summarizing appropriately is the freedom of an editor.--Wuerzele (talk) 05:35, 8 February 2015 (UTC)

- Of course, summarizing is the right. But leaving out a substantial half of a definition, pretending that what is left is "the definition" is not summarizing. Summarizing would be to tell that FinCEN wrote a definition in 2013. Once there is the statement "defined as", and the text differs from the actual definition, it is not a summary, it is just a new definition different from the original. Insertion of such a definition violates WP:NOR. To simplify the issue, and to respect the right to summarize, I remove the incorrect definition from the lead section, leaving only the summary info in there. Ladislav Mecir (talk) 09:40, 8 February 2015 (UTC)

Cryptocurrency task force Invite

[edit]| File:Altcoins symbols.png | Hello Virtual currency. You are cordially invited to participate in the Cryptocurrency Task Force (part of WikiProject Numismatics) a project dedicated on improving Wikipedia's coverage and detail regarding all things related to cryptocurrencies. |

-- 1Wiki8........................... (talk) 10:20, 24 September 2015 (UTC)

Joining a community would jeopardize the independence and impartiality of virtual currency. Wikipedia itself is the forum and the medium.

virtual currency vs cryptocurrency?

[edit]In most people's commen sense, the term "cryptocurrency" also refers to digital currencies that are neither issued by central banks nor regulated by public entities, and are not backed by fiat currency. What, then, is the difference between these two concepts? MaximilienLuc (talk) 09:48, 2 July 2024 (UTC)

- Virtual currency is a more expansive term, which includes currencies that make no use of blockchain. Read the article, you'll see examples. MrOllie (talk) 11:23, 2 July 2024 (UTC)

- C-Class Economics articles

- Mid-importance Economics articles

- WikiProject Economics articles

- C-Class Finance & Investment articles

- High-importance Finance & Investment articles

- WikiProject Finance & Investment articles

- C-Class Computing articles

- Low-importance Computing articles

- C-Class software articles

- Low-importance software articles

- C-Class software articles of Low-importance

- All Software articles

- C-Class Computer Security articles

- Low-importance Computer Security articles

- C-Class Computer Security articles of Low-importance

- All Computer Security articles

- All Computing articles

- C-Class numismatic articles

- Low-importance numismatic articles

- WikiProject Numismatics articles

- C-Class WikiProject Cryptocurrency articles

- High-importance WikiProject Cryptocurrency articles

- WikiProject Cryptocurrency articles

- Wikipedia requested charts