User:Psyc4600/Group13

Neuroeconomics is an interdisciplinary field, drawing from theories and methodologies in both economics and neuroscience.

Overview

[edit]The overall aim of neuroeconomics is to understand the neural systems that underlie the decision-making process and to improve models of human behaviour to better predict economic and social behaviours.[1] Neuroscientists mainly focus on discovering the precise neural structures that play a role in decision-making, while economists mainly focus on improving predictive economic models or finding why a current model may fail.[2]

It has been suggested that if neuroscience is to add value to economics, it must suggest new insights and useful perspectives on old problems[3]. Neuroscience has the ability to raise questions about some of the most common economic constructs, such as risk aversion, time preference, and altruism. Through the use of brain imaging while people are winning or losing money, it has been demonstrated that money activates similar “reward areas” as do other primary reinforcers, like food and drugs. These studies imply that money confers direct utility, rather than just being valued for its ability to be used to buy other items.[3] This discovery will have some implications for the field of economics, in which current models view money as having indirect utility.

Method for Experimental Study

[edit]Neuroeconomic studies are generally structured with four basic methodological principals.

(1) Choosing a formal model of rationality, a decision- or a game-theoretic situation, and then deducing what decisions agents should make.

(2) Testing the model behaviorally to see if subjects follow normative standards.

(3) Identifying the brain areas and neural mechanisms that underlie choice behavior.

(4) Explaining why subject follow/fail to follow normative standards [4]

History of Neuroeconomics

[edit]Neuroeconomics is a relatively new area that is being researched. This field of study is based on bioeconomics, which is used to build models based on biological evolution to predict human behaviour, as well as from behavioural economics, which uses cognitive psychology to model human decision making.[2] Although its roots run deep in human behaviour models, neuroeconomics is not confined to human studies due to the fact that it is more concerned with mapping brain functions than it is creating human behaviour models. One of the earliest papers written using a neuroenconomic approach was based on a study involving decision making in rhesus monkeys in 1999.[2]

The first neuroeconomists meeting took place in the fall of 2003 and included 30 professionals, approximately one third of which had a Ph.D in Neuroscience, one third had a Ph.D in Economics, and one third had an M.D. The diverse selection of professionals demonstrates the potential power of this up and coming field.[2]

Delay Discounting

[edit]Delay discounting, also known as temporal discounting, is a term used to describe the decrease in subjective value of a reward as a function of time of its delivery. This means that when provided with the choice of a small immediate reward and a larger delayed reward, subjects are more likely to choose the immediate one.[5]

Discounting Models

[edit]Current behavioral studies of both humans and animals demonstrate that choosers are impulsive. Neuroeconomics provides insight into models of delay discounting by exploring the current models that are available. It was previously assumed that delay discounting was modeled by an exponential function.[5] This exponential model is known as discounted utility (DU) in economics, and implies that a given time delay leads to the same amount of discounting regardless of when it occurs. [6] Empirical evidence suggests that delay discounting does not follow an exponential model. The difference between normative models and empirical evidence is typically explained by the suggestion that humans suffer from an internal conflict between impulse and other forces, which call for delayed gratification.[5] Although this is the typical explanation, recent neuroeconomic research has provided no evidence that there is an internal conflict occurring in the physical processes in the brain. Delay discounting may actually follow a hyperbolic function as opposed to the exponential function in the DU model. There have been numerous hypotheses that support the idea that humans view the future hyperbolically, with the most common hypothesis stating that hyperbolic time discounting is evident in humans due to evolution.[6] These hypotheses do not come without critics; the fact that our closest evolutionary relative's measured discount function drops to zero after about one minute.[6] This means that, at best, these evolutionary relatives can hold value to delayed gratification for one minute.

Neural Processes in Delay Discounting

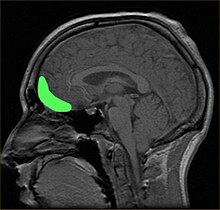

[edit]Through the use of brain imaging it has been shown that there are two distinct neural systems in the brain activated during delay discounting: limbic and paralimbic cortical structures, and fronto-parietal regions.[6] The limbic and paralimbic systems are activated for choices involving immediately available rewards. This may be due to the fact that both the limbic and paralimbic cortical structures are rich in dopaminergic innervation.

Activation in the fronto-parietal regions, supporting higher cognitive functioning, is associated with all intertemporal choices. It is important to note that the fronto-parietal region is not active during rest conditions, demonstrating that it is not “always on” and is essential for making these choices.

It has also been observed that when a choice is presented, allowing for an immediate reward, activating both systems, the system with the higher activation indicates the choice made.[6] This means that if a person was to choose the smaller immediate reward, the limbic and paralimbic cortical structures would have higher amounts of activation than the fronto-parietal region. The opposite effects are also true, if the decision was to delay the reward, there would be greater activation in the fronto-parietal region than in the limbic and paralimbic cortical structures. [6]

Substance Abuse

[edit]Individuals who suffer from substance abuse have higher amounts of discounting relative to non-substance abusing individuals.[7] There has been similar research that has shown that other measures of impulsivity have the same findings.[7]

Gambling Models

[edit]Neuroeconomics has implicated the ventromedial prefrontal cortex (VMPFC) and insular cortex (or insula) in emotional decision-making[8]. Various studies of patients with brain lesions, as well as functional imaging studies in healthy volunteers, have provided insights into the underlying neural circuitry of decision-making. Such studies have implicated the ventral and medial sectors of the prefrontal cortex, the insular cortex, and the striatum, amygdala, and parietal cortex[8].

Iowa Gambling Task

[edit]The Iowa Gambling Task (IGT) is a well-established measure of the role of emotion in decision-making, and demonstrates the extent to which learning based on emotion is useful in dealing with complex problem-solving situations[9]. The task requires subjects to learn the profile of wins and losses associated with four card decks. Two decks are considered 'risky' decks, as they yield high immediate wins, but have dramatic occasional losses, resulting in gradual debt over time. The other two decks are considered 'safe' decks, as they deliver smaller wins with minor losses, such that there is an overall profit[9]. Healthy controls rapidly learn to select from the safe decks, while patients with VMPFC damage fail to learn an advantageous strategy and maintain preference for the risky decks[9].

Cambridge Gamble Task

[edit]The Cambridge Gamble Task is a measure of risky decision-making, where outcome probabilities are presented explicitly, thus minimizing learning and working memory demands[8]. While the IGT assesses decision-making under ambiguous conditions, where the outcomes are uncertain and the outcome probabilities are unknown or estimated, the Cambridge Gamble Task assesses risky decision-making based on known outcome probabilities. For this task, subjects are presented with an array of 10 red and blue boxes and told that a token is hidden under one of the boxes. While explicitly knowing the ratio of red to blue boxes, subjects guess whether the token is hidden under a red or blue box, and wager a proportion of points on that decision. Potential wagers are offered in an ascending or descending sequence, such that risky subjects must wait to place high wages in the ascend condition. The task is successful in assessing decision-making under risk rather than ambiguity[8].

Lesions to the VMPFC and insular cortex produce selective and distinctive deficits on this task. Focal lesions of the dorsolateral or dorsomedial PFC impaired IGT performance, but did not significantly affect performance on the Cambridge Gamble Task[8].

Patients with VMPFC lesions showed increased betting compared to healthy controls, and this effect was apparent regardless of the chances of winning. Patients with damage to the insular cortex also placed higher wagers in comparison to the healthy participants; however, the effects on betting differed between the insular cortex and VMPFC lesion groups, such that those with insular cortex lesions were less sensitive to the odds of winning[8].

Experimental Findings

[edit]Evidence from studies utilizing various brain imaging techniques, such as functional magnetic resonance imaging (fMRI), electroencephalography (EEG), and single-neuron recording, have implicated specific brain regions in aspects of decision-making. This functional specialization has recently been explored by neuroscientists through experimental methods.

Prefrontal cortex

[edit]Ventromedial prefrontal cortex

[edit]- Main article: ventromedial prefrontal cortex

The ventromedial prefrontal cortex (VMPFC) may have an ambiguity-sensitive mechanism associated with the expression of emotion. This may be responsible for choice under some conditions. The somatic marker hypothesis proposes that the inability of patients with VMPFC lesions to make advantageous decisions under some circumstances is caused by damage to an emotional mechanism that stores and signals the value of future consequences of action[1].

Left medial prefrontal cortex

[edit]Based on converging evidence, many neuroscientists believe there is a specialized “mentalizing” (or “theory of mind”) area of the brain, which controls a person’s inferences about what other people believe, feel, or might do.[3] fMRI studies show greater activation in the left medial prefrontal cortex of normal adults when presented with judgment problems that require mentalizing, over closely matching problems that do not require mentalizing[11][12] Such findings are important for economics, as many judgments require agents to make guesses about how other people feel or how they will act.[3]

Posterior parietal cortex

[edit]- Main article: posterior parietal cortex

Regions of the lateral prefrontal cortex and posterior parietal cortex which are typically viewed as more cognitive regions, are engaged uniformly by intertemporal choices irrespective of delay[3]. Studies have found that the posterior parietal cortex plays a critical role in perceptual decision-making[13]. Evidence was gained for the posterior parietal cortex's role in economical decision-making by monitoring activity of neurons in the posterior parietal cortex of monkeys while participating in repeated rounds of a simple lottery. It was found that some parietal neurons encode the value and likelihood of reinforcement[14].

Mesolimbic system

[edit]- Main article: mesolimbic system

Neural evidence suggests that the same dopaminergic reward circuitry in the mesolimbic system is activated by many different reinforcers[15] including attractive faces[16], funny cartoons[17], cultural objects like sports cars[18], drugs[19], and money[20][21][22]. This suggests that money provides direct reinforcement, countering the standard economic model that assumes that the utility for money is indirect, meaning it is only valued for the goods and services it can buy. fMRI scans provide support that parts of the limbic system associated with the midbrain dopamine system are preferentially activated by options involving immediate rewards[3].

Orbitofrontal cortex

[edit]- Main article: orbitofrontal cortex

The orbitofrontal cortex (OFC) receives input from the limbic system (including the insular cortex and amygdala). fMRI studies found activation of these structures when subjects were faced with ambiguous choices compared to risky ones[23]. It was also found that patients with OFC lesions are ambiguity-neutral compared to brain damaged controls. fMRI and lesion evidence implies that, in normal subjects, ambiguous gambles often create discomfort or fear, which is transmitted to the OFC. Therefore, patients with OFC damage behave more "rationally" than normal individuals, thus treating ambiguous and risky gambles similarly[24].

Hemispheres of the brain

[edit]fMRI evidence suggests that the left hemisphere of the brain is more active when guessing probabilities, while the right hemisphere of the brain is more active when answering logical questions[25] Such findings can explain why subjects who report logically incoherent probabilities can correct themselves upon reflection. Since enforcing logical coherence requires the right hemisphere to "check the work" of the left hemisphere, there is room for error[3].

Challenges & Critiques

[edit]As an emerging interdisciplinary field, neuroeconomics faces considerable methodological and practical challenges. The rise of neuroeconomics can be compared to the emergence of cognitive and computational neuroscience during the late 1980’s and as such, similar challenges are faced [26]. The main challenge to neuroeconomics is bridging the disciplinary gap between cognitive neuroscience and economics. Blending two distinct disciplines with diverse methods and terminologies creates many challenges and even potentially creates a complete paradigm shift [27]. Most economists are curious about neuroscience, but the tradition of ignoring psychological regularity in making assumptions in economic theory is deeply ingrained[3]. For most economists, the most valuable contribution of neuroeconomics goes further than providing just a spatial picture of where things happen in the brain. The challenge is showing a neural basis that represents different types of judgments predicated on observable variables[3]. This understanding of functional specialization and how different brain regions collaborate for different tasks can be used to categorize similar economic behaviours [3]. Neuroscientists respond to economists’ arguments by contending that the many failures of traditional economics to make accurate predictions about human behavior reflects an inattention to mechanism. Understanding how decisions are made by the brain can yield algorithmic alternatives to neoclassical theory with enhanced predictive power[3]. Neuroscientists often outline the deficiencies of how economists currently model intertemporal choice. Economists rely primarily on a utility model for intertemporal choice, but this form of analysis fails to recognize processes such as drives and emotions[3]. The biggest challenge to neuroeconomic modeling remains the power to show a neural basis for certain kinds of choices or judgements, which predict how an observable variable would influence choices in a reduced–form model.

Future Directions & Branches of Neuroeconomics

[edit]Neuroethics

[edit]- Main Article: neuroethics

Neuroethics studies behaviours that are almost universally considered wrong. A neuroethics study would be one where the participant is asked if it is morally acceptable to personally kill one person in order to save five others from certain death. This type of study has little economic measure, but findings can help demonstrate extent of neural activity during personal moral dilemmas[2]. Neuroethics encompasses the numerous ways in which developments in basic and clinical neuroscience intersect with social and ethical issues.

Neuroethics and the Law

[edit]It is understood that everyone comprehends the rules of basic law, but not everyone follows such fundamental rules. Neuroethics experiments that measure individuals’ responses to situations under varied legal regimes, can be useful to improve public policy. Neuroeconomics and neuroethics affect law making, in that laws are designed to limit personal moral violations[2].

Neuromarketing

[edit]- Main article: Neuromarketing

Neuromarketing is a new field of marketing that studies consumers' sensorimotor, cognitive, and affective responses to marketing stimuli. The use of fMRI allows researchers to isolate and measure neural activity associated with decision making and persuasion[28].

Marketing analysts will use neuromarketing to better measure a consumer's preference, as the verbal response given to the question, "Do you like this product?" may not always be the true answer due to cognitive bias. This knowledge will help marketers create more effectively designed products and services, and marketing campaigns that focus primarily on the brain's responses. This makes neuromarketing and its applied results potentially subliminal[27] [28].

Neuromarketing has raised issues of ethical concern because corporations are empowering neuromarketing persuasion techniques to influence buying habits. Some scholars argue that this problem arises with all marketing persuasion attempts, since they are placed in our sensory path without tacit permission, and the strategic intentions of the marketers remain unknown. A fundamental distinction between classic marketing tactics and neuromarketing strategies, however, is that the former attempts to change beliefs, attitudes, and behaviours through explicit product placement strategies, while the latter are expert attempts to trigger buying emotions in consumers.[28].

The word "neuromarketing" was coined by Ale Smidts in 2002. [29]

References

[edit]- ^ a b Glimcher, P. W., and Rustichini, A., (2004). Neuroeconomics: The Consilience of Brain and Decision. Science, 306, 447-452.

- ^ a b c d e f Zak, P. J., (2004). Neuroeconomics. The Royal Society, 359, 1737–1748.

- ^ a b c d e f g h i j k l Camerer, C., Loewenstein, G., and Prelec, D., (2005). Neuroeconomics: How Neuroscience Can Inform Economics. Journal of Economic Literature, 43, 9-64. Cite error: The named reference "Camerer" was defined multiple times with different content (see the help page).

- ^ Hardy-Vallée, B., (2007). Decision-Making: A Neuroeconomic Perspective. Philosophy Compass, 2:6, 939-953.

- ^ a b c Glimcher, P. W., Kable, J., and Louie, K. (2007). Neuroeconomic Studies of Impulsivity: Now or Just as Soon as Possible? AEA Papers and Proceedings, 1-6.

- ^ a b c d e f Loewenstein, G., Rick, S., and Cohen, J., D. (2007). Neuroeconomics. Annual Review of Psychology, 647-672.

- ^ a b Bickel, W. K., and Marsch, L. A. (2001). Toward a behavioral economic understanding of drug dependence: delay discounting processes. Addiction, 96, 73-86.

- ^ a b c d e f Clark, L., Bechara, A., Damasio, H., Aitken, M. R. F., Sahakian, B. J., Robbins, T. W. (2008). Differential effects of insular and ventromedial prefrontal cortex lesions on risky decision-making. Brain, 131, 1311-1322.

- ^ a b c Bechara, A., Damasio, A. R., Damasio, H., Anderson, S. W. (1994). Insensitivity to future consequences following damage to human prefrontal cortex. Cognition, 50, 7-15.

- ^ Bechara, A; Damasio, H; Tranel, D; & Anderson, SW; (1998). "Dissociation Of Working Memory from Decision Making within the Human Prefrontal Cortex". Journal of Neuroscience 18: 428-437.

- ^ Fletcher, P. C., Happe, F., Frith, U., Baker, S. C., Dolan, R. J., Frackowiak, R. S., Frith, C. D. (1995). Other Minds in the Brain: A Functional Imaging Study of "Theory of Mind" in Story Comprehension. Cognition, 57, 2, 109-28.

- ^ Saxe, R., Kanwisher, N. (2003). People Thinking about Thinking People: The Role of the Temporo-Parietal Junction in 'Theory of Mind.' Neuroimage, 19, 4, 1835-1842.

- ^ Shadlen, M. N., Newsome, W. T. (2001). Neural Basis of a Perceptual Decision in the Parietal Cortex (Area LIP) of the Rhesus Monkey. Journal of Neurophysiology, 86, 4, 1916-1936.

- ^ Platt, M. L., Glimcher, P. W. (1999). Neural Correlates of Decision Variables in Parietal Cortex, Nature, 400, 233-238.

- ^ Montague, P. R., Berns, G. S. (2002). Neural Economics and the Biological Substrates of Valuation. Neuron, 36, 2, 265-284.

- ^ Aharon, I., Etcoff, N., Ariely, D., Chabris, C. F., O'Connor, E., Breiter, H. C. (2001). Beautiful Faces Have Variable Reward Value: fMRI and Behavioral Evidence. Neuron, 32, 3, 537-551.

- ^ Mobbs, D., Greicius, M. D., Abdel-Azim, E., Menon, V., Reiss, A. L. (2003). Humor Modulates the Mesolimbic Reward Centers. Neuron, 40, 5, 1041-1048.

- ^ Erk, S., Spitzer, M., Wunderlich, A. P., Galley, L., Walter, H. (2002). Cultural Objects Modulate Reward Circuitry. Neuroreport, 13, 18, 2499-2503.

- ^ Schultz, W. (2002). Getting Formal with Dopamine and Reward. Neuron, 36, 2, 241-263.

- ^ Breiter, H. C., Aharon, I., Kahneman, D., Dale, A., Shizgal, P. (2001). Functional Imaging of Neural Responses to Expectancy and Experience of Monetary Gains and Losses. Neuron, 30, 2, 619-639.

- ^ Knutson, B., Peterson, R. (2005). Neurally Reconstructing Expected Utility. Games and Economic Behavior, 52, 2, 305-315.

- ^ Delgado, M. R., Nystrom, L. E., Fissell, C., Noll, D. C., Fiez, J., A. (2000). Tracking the Hemodynamic Responses to Reward and Punishment in the Striatum. Journal of Neurophysiology, 84, 6, 3072-3077.

- ^ Hsu, M., Bhatt, M., Adolphs, R., Tranel, D., Camerer, C. F. (2005). Neural Systems Responding to Degrees of Uncertainty in Human Decision-Making, Science, 310:5754, 1680-1683.

- ^ Shiv, B., Loewenstein, G., Bechara, A. (2005). The dark side of emotion in decision-making: When individuals with decreased emotional reactions make more advantageous decisions, Cognitive Brain Research, 23:1, 85-92.

- ^ Parsons, L. M., Osherson, D. (2001). New Evidence for Distinct Right and Left Brain Systems for Deductive versus Probabilistic Reasoning. Cerebral Cortex, 11, 10, 954-965.

- ^ Quartz, S. R., (2008). From Cognitive Science to Cognitive Neuroscience to Neuroeconomics. Economics and Philosophy, 24, 459-471.

- ^ a b Politser, P, (2008). Neuroeconomics: A guide to the New Science of Making Choices. Journal of Neuroscience, Psychology, and Economics, 2, 68-69.

- ^ a b c Wilson, R. M., (2008). Neuromarketing and Consumer Free Will. The Journal of Consumer Affairs, 42:3, 389-410.

- ^ David Lewis & Darren Brigder (2005). "Market Researchers make Increasing use of Brain Imaging" (PDF). Advances in Clinical Neuroscience and Rehabilitation. 5 (3): 35+.

{{cite journal}}: Unknown parameter|month=ignored (help)