Covered option

A covered option is a financial transaction in which the holder of securities sells (or "writes") a type of financial options contract known as a "call" or a "put" against stock that they own or are shorting. The seller of a covered option receives compensation, or "premium", for this transaction, which can limit losses; however, the act of selling a covered option also limits their profit potential to the upside. One covered option is sold for every hundred shares the seller wishes to cover.[1][2]

A covered option constructed with a call is called a "covered call", while one constructed with a put is a "covered put".[1][2] This strategy is generally considered conservative because the seller of a covered option reduces both their risk and their return.[1]

Characteristics

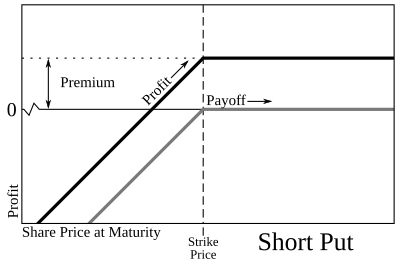

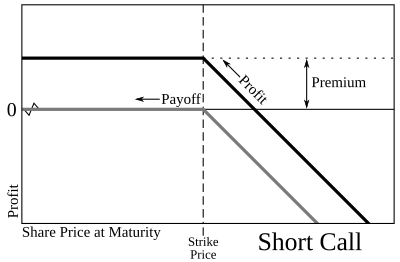

[edit]Covered calls are bullish by nature, while covered puts are bearish.[1][2] The payoff from selling a covered call is identical to selling a short naked put.[3] Both variants are a short implied volatility strategy.[4]

Covered calls can be sold at various levels of moneyness. Out-of-the-money covered calls have a higher potential for profit, but also protect against less risk, as compared to in-the-money covered calls.[1]

See also

[edit]References

[edit]- ^ a b c d e MacMillan, Lawrence (2002). Options as a strategic investment (4th ed.). New York Institute of Finance. ISBN 978-0735202382.

- ^ a b c Butler, Mike (2 February 2016). "Trading Strategy Covered Put". Tastytrade. Retrieved 10 April 2022.

- ^ Natenberg, Sheldon (1994). Option volatility and pricing: advanced trading strategies and techniques (1st ed.). McGraw Hill. pp. 260–263.

- ^ Zeng, Kai; Schultz, Jim (29 September 2021). "Covered Calls & Poor Man's Covered Calls". Tastytrade. Retrieved 10 April 2022.

Bibliography

[edit]- Brill, Maria. "Options for Generating Income." Financial Advisor. (July 2006) pp. 85–86.

- Calio, Vince. Covered Calls Become Another Alpha Source." Pensions & Investments. (May 1, 2006).

- "Covered Call Strategy Could Have Helped, Study Shows" Pensions & Investments, Sept. 20, 2004, p. 38.

- Crawford, Gregory. "Buy Writing Makes Comeback as Way to Hedge Risk." Pensions & Investments. May 16, 2005.

- Demby, Elayne Robertson. "Maintaining Speed -- In a Sideways or Falling Market, Writing Covered Call Options Is One Way To Give Your Clients Some Traction." Bloomberg Wealth Manager, February 2005.

- Feldman, Barry, and Dhruv Roy, "Passive Options-Based Investment Strategies: The Case of the CBOE S&P 500 BuyWrite Index." The Journal of Investing . (Summer 2005).

- Frankel, Doris. "Buy-writes Catch on in Sideways U.S. Stock Market." Reuters. (Jun 17, 2005).

- Fulton, Benjamin T., and Matthew T. Moran. "BuyWrite Benchmark Indexes and the First Options-Based ETFs" Institutional Investor—A Guide to ETFs and Indexing Innovations (Fall 2008), pp. 101–110.

- Szado, Edward, and Thomas Schneeweis. QQ_Active_Collar_Paper_website_v3 "Loosening Your Collar: Alternative Implementations of QQQ Collars.[permanent dead link]" CISDM, Isenberg School of Management, University of Massachusetts, Amherst. (Original Version: August 2009. Current Update: September 2009).

- Kapadia, Nikunj, and Edward Szado. "The Risk and Return Characteristics of the Buy-Write Strategy on the Russell 2000 Index." The Journal of Alternative Investments. (Spring 2007). pp. 39–56.

- Renicker, Ryan, Devapriya Mallick. "Enhanced Call Overwriting." Lehman Brothers Equity Derivatives Strategy. (Nov 17, 2005).

- Tan, Kopin. "Better Covered Calls. Covered-Call Writing Yields Higher Returns in Down Markets." Barron's: The Striking Price. (Nov 28, 2005).

- Tan, Kopin. "More Bang, Less Buck. Selling Call Options." Barron's, SmartMoney. (Dec. 2, 2005).

- Hill, Joanne, Venkatesh Balasubramanian, Krag (Buzz) Gregory, and Ingrid Tierens. "Finding Alpha via Covered Index Writing." Financial Analysts Journal. (Sept.-Oct. 2006). pp. 29–46.

- Lauricella, Tom. "'Buy Write' Funds May Well Be The Right Strategy." Wall Street Journal. (Sep 8, 2008). pg. R1.

- Moran, Matthew. "Risk-adjusted Performance for Derivatives-based Indexes - Tools to Help Stabilize Returns." The Journal of Indexes. (Fourth Quarter, 2002) pp. 34 – 40.

- Schneeweis, Thomas, and Richard Spurgin. "The Benefits of Index Option-Based Strategies for Institutional Portfolios" The Journal of Alternative Investments, Spring 2001, pp. 44 – 52.

- Tan, Kopin. "Covered Calls Grow in Popularity as Stock Indexes Remain Sluggish." The Wall Street Journal, April 12, 2002.

- Tergesen, Anne. "Taking Cover with Covered Calls." Business Week, May 21, 2001, p. 132.

- Tracy, Tennille. "'Buy-Write' Is Looking Attractive." The Wall Street Journal. (Dec 1, 2008). pg. C6.

- Whaley, Robert. "Risk and Return of the CBOE BuyWrite Monthly Index." The Journal of Derivatives (Winter 2002) pp. 35 – 42.